Key Takeaways

- Strong foundation matters: Professional banking courses build essential technical and financial skills that make candidates job-ready.

- Hands-on exposure boosts confidence: Simulations, projects, and customer handling exercises prepare students for real-world banking challenges.

- Placement-focused approach ensures success: Structured grooming, interview preparation, and direct campus-to-corporate placement maximize chances of landing high-paying bank jobs.

Step 1: Building Strong Fundamentals with Professional Banking Courses

Professional banking courses start by strengthening your foundation in finance, accounting, and banking principles. Understanding these core concepts ensures you can handle the practical demands of both retail and corporate banking roles. With a structured curriculum, students learn everything from banking regulations to financial instruments, giving them the confidence to perform effectively in entry-level roles and beyond.

Step 2: Learning Core Banking Operations

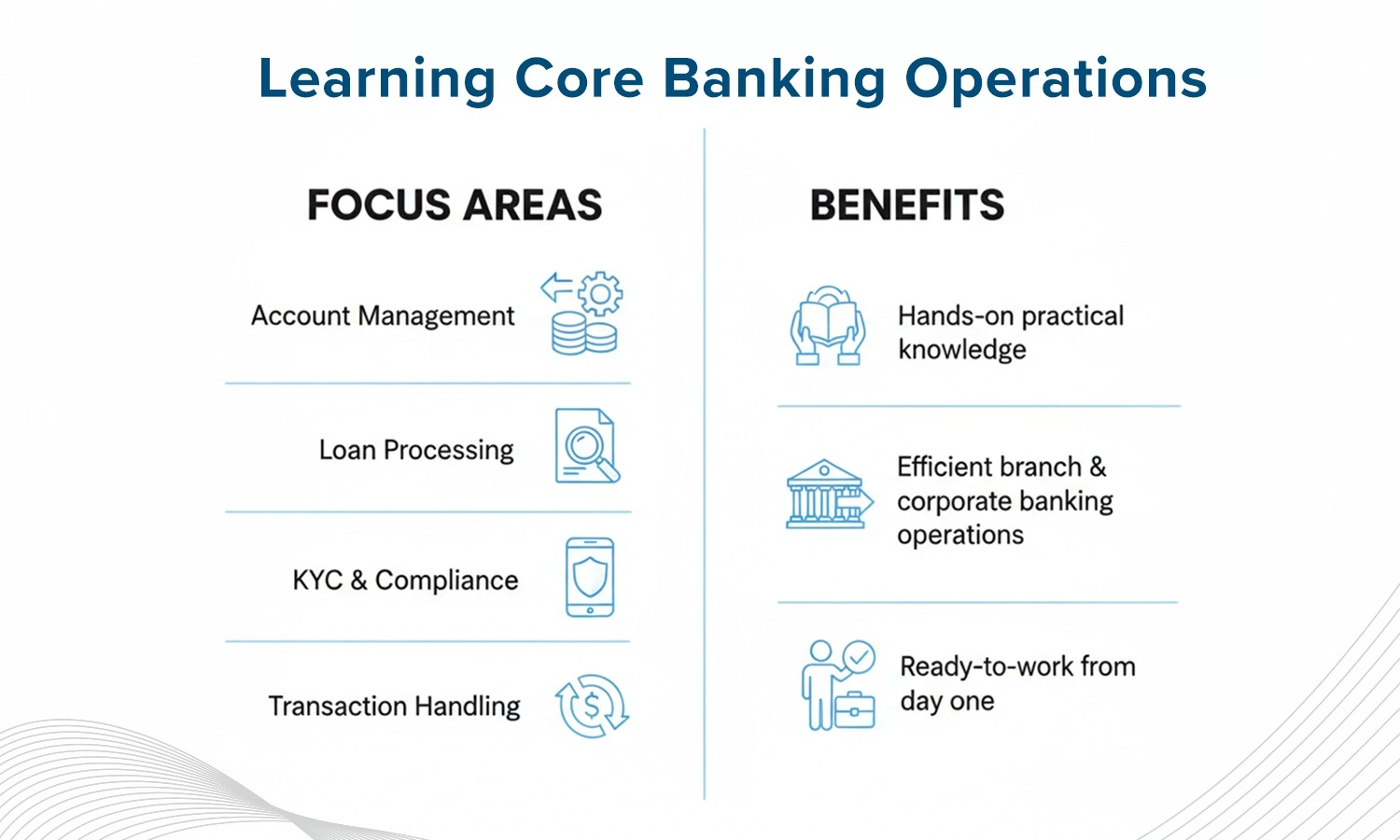

A critical focus of professional banking courses is teaching day-to-day banking operations. Students get hands-on knowledge of account management, loan processing, KYC procedures, digital banking, and transaction handling. This equips candidates to navigate branch operations and corporate banking tasks efficiently, making them highly employable from day one.

Step 3: Developing Customer Service & Communication Skills

Excellent communication and client-handling skills are vital in the BFSI sector. Professional banking courses train students to interact professionally, resolve customer queries, and manage client portfolios. These skills not only enhance customer satisfaction but also increase a candidate’s chances of being recognized for promotions and higher-paying roles.

Step 4: Hands-On Training Through Simulations & Projects

Practical exposure through real-world simulations and live projects is a hallmark of professional banking courses. Students gain familiarity with banking software, digital tools, and workflow management. These exercises bridge the gap between theoretical knowledge and industry expectations, ensuring graduates are confident and job-ready.

Step 5: Placement-Focused Grooming & Interview Training

Professional banking courses emphasize interview readiness, grooming, and professional etiquette. Mock interviews, group discussions, and resume workshops help candidates present themselves effectively to recruiters. This structured training increases the chances of success during placement drives and corporate interviews.

Step 6: Direct Campus-to-Corporate Placement Assistance

Many professional banking courses provide direct links with private banks and BFSI firms. Campus-to-corporate placement support ensures students are introduced to hiring managers, attend scheduled interviews, and are guided throughout the recruitment process. This bridge reduces the typical gap between academia and industry.

Join SRMSB today and start your journey toward a rewarding BFSI career!

Step 7: Entry into High-Paying Private Bank Jobs

Graduates from professional banking courses are often preferred for entry-level roles in private banks, where performance-based incentives and growth opportunities are abundant. The combination of technical know-how, soft skills, and placement preparedness positions candidates to secure higher starting salaries compared to peers without structured training.

Step 8: Why SRM School of Banking is the Bridge to High-Paying Jobs

SRM School of Banking’s professional banking courses combine academic rigor with practical exposure, producing some of the extraordinary finance and banking courses. Placement assured program With hands-on projects, soft skills training, and direct placement assistance with top private banks, SRMSB ensures that graduates enter the BFSI sector with confidence, competence, and a strong potential for rapid career growth.

FAQs

Structured programs designed to teach both technical and soft skills for BFSI careers, including placement support.

Yes, most courses are tailored for freshers aiming to start their careers in private and corporate banks.

Entry-level private bank roles typically offer ₹3–5 LPA, with performance-linked incentives increasing earning potential.

Yes, placement-focused professional banking courses provide direct campus-to-bank placement assistance and interview guidance.