Key Takeaways

- Private bank jobs vs public bank jobs differ in career growth speed, salary structure, and skill-based opportunities.

- Public banks offer security and stability, while private banks reward performance and innovation.

- Completing a placement-assured banking program from SRMSB enables fresh graduates to confidently enter the private banking industry.

Choosing between private bank jobs vs public bank jobs is a common dilemma for banking aspirants. Public banks promise stability and security, while private institutions offer faster growth and higher pay.

Job Security and Salary Structure Comparison

When comparing private bank jobs vs public bank jobs, one of the biggest differences lies in job security and pay structure. Public banks are government-backed, providing long-term stability, fixed working hours, and structured pay scales. Salaries are consistent, accompanied by added benefits, including a pension and job security.

Private banks, on the other hand, operate on performance-based incentives. While they offer higher starting salaries and faster promotions, job security is linked to performance metrics and targets. Freshers in private bank roles often start with competitive packages and enjoy annual bonuses tied to results.

For ambitious graduates who value growth and earnings potential over fixed structures, private banking becomes the ideal choice, proving to be the best option for private bank fresher jobs.

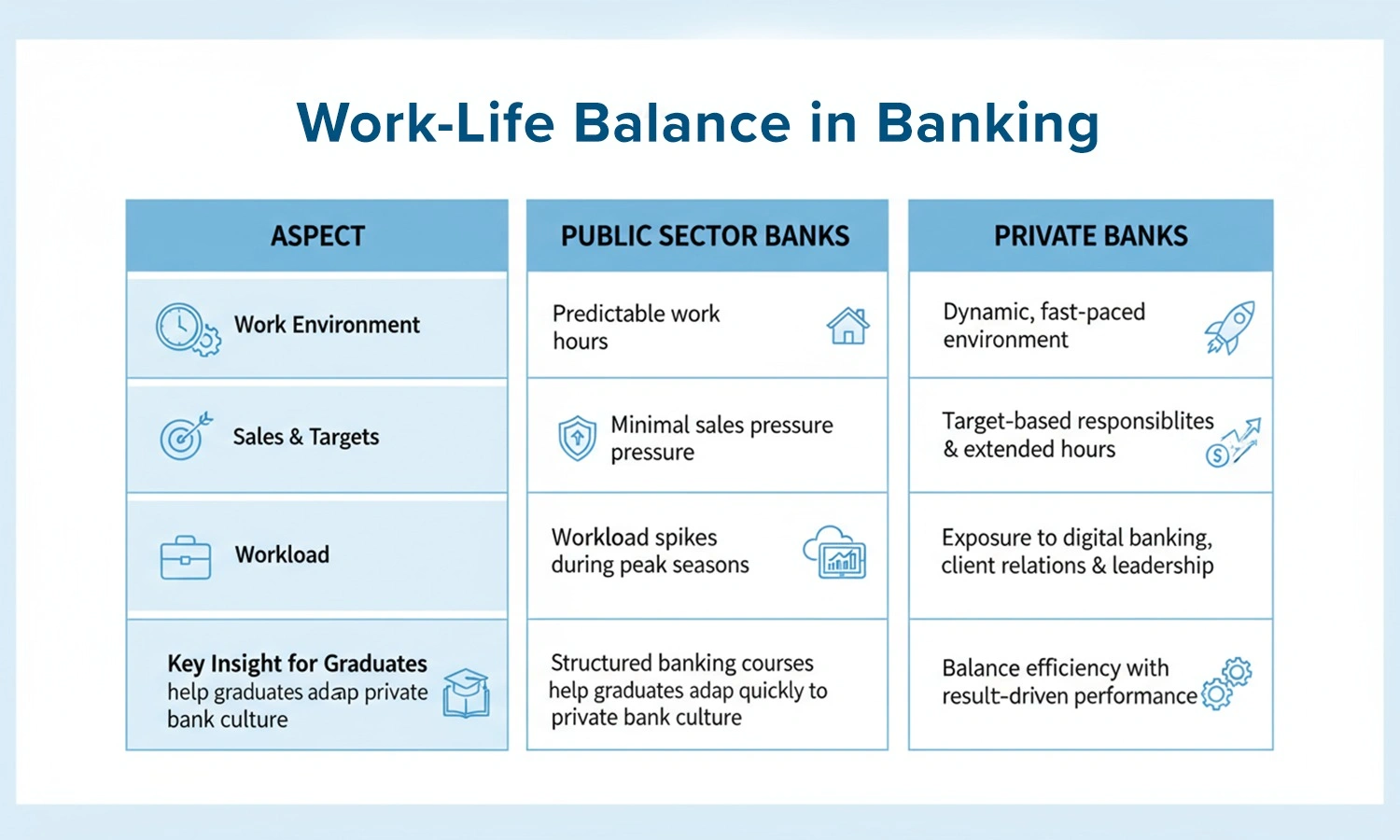

Work-Life Balance Analysis

Public sector banks generally have predictable work hours and minimal sales pressure, making them suitable for those seeking balance. However, workloads can still be demanding during peak banking seasons.

Private banks, while dynamic and high-paced, focus on productivity and client service. Employees may experience extended hours or target-based responsibilities, but the exposure to digital banking, customer relations, and leadership roles builds strong professional growth.

Graduates who complete structured banking courses often adapt better to the private bank work culture, balancing efficiency with results-driven performance.

Fast-Track Career in Private Banks

Public bank promotions follow seniority and service duration, resulting in slower upward movement. While steady, it lacks the agility of private banking environments.

For driven individuals aiming for leadership roles early in their careers, private banking provides the platform to grow faster and earn better. These are some of the benefits of private bank jobs.

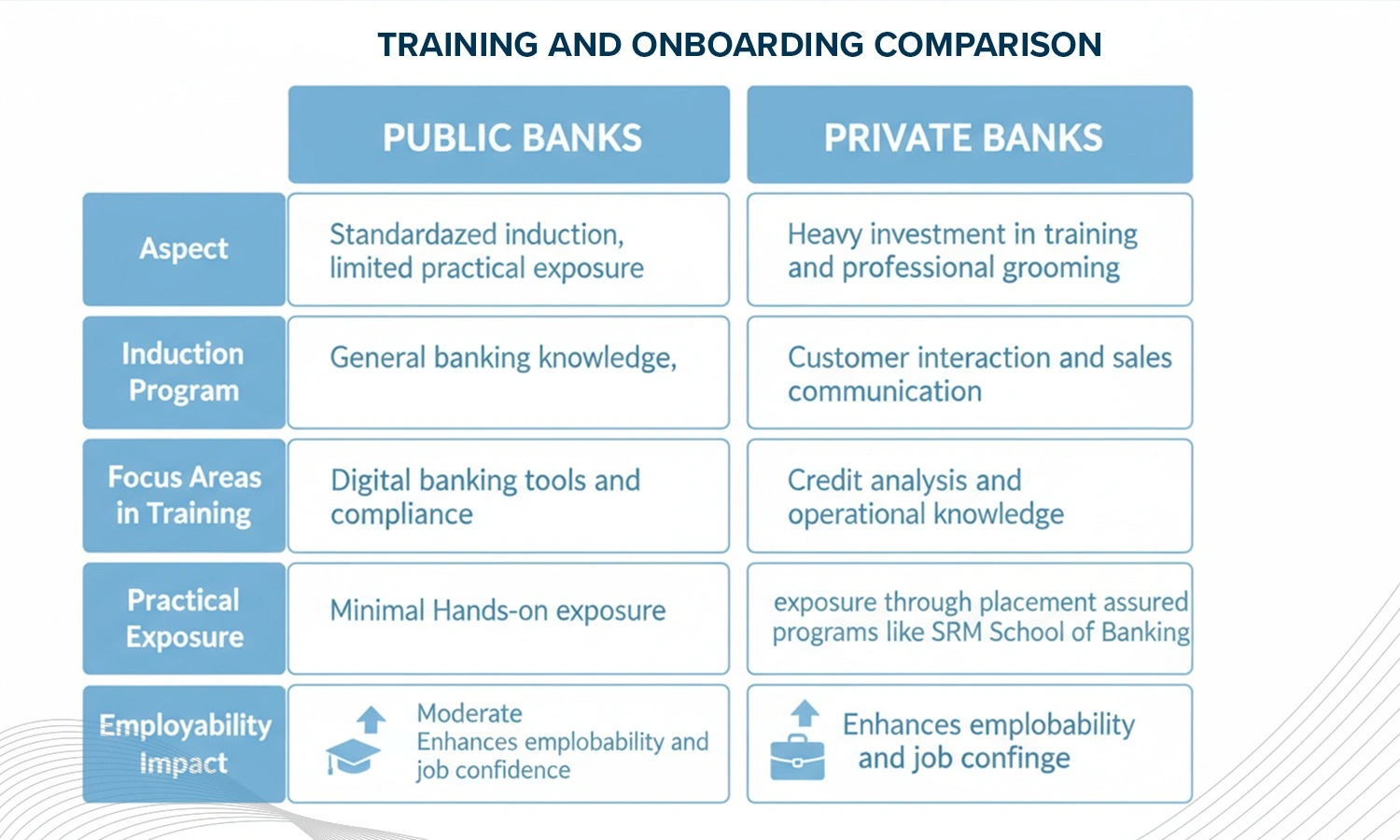

Training and Onboarding Comparison

Public banks generally offer standardized induction programs with limited practical exposure. In contrast, private banks invest heavily in bank job training and professional grooming to ensure recruits are ready to perform from day one.

Private bank training modules focus on:

- Customer interaction and sales communication

- Digital banking tools and compliance

- Credit analysis and operational knowledge

Completing a placement-assured banking program, like that of SRM School of Banking, ensures students get hands-on exposure before entering the workforce, enhancing employability and job confidence.

Recruitment Process for Private and Public Banks

Public bank recruitment is typically done through national-level exams like IBPS or SBI PO, followed by interviews and document verification. The process is competitive and time-consuming, often taking months to complete.

Private bank recruitment, however, focuses on direct campus drives, referrals, and specialized training programs. Banks like HDFC, Axis, and ICICI prefer candidates who have undergone structured private bank recruitment training and possess practical banking knowledge.

Graduates from industry-aligned training programs stand out due to their readiness to meet private bank performance standards. These are some of the best fresher jobs in private banks.

SRMSB’s Role in Private Bank Placements

SRM School of Banking (SRMSB) plays a transformative role in bridging education and employment for banking aspirants. With its placement assured banking program, students gain:

- Real-world exposure to retail, corporate, and digital banking.

- Mock interviews, roleplays, and resume guidance tailored to private bank hiring standards.

- Direct connections with leading private banks for interviews and placements.

Through SRMSB, graduates don’t just get trained, they get placed through some of the best and crucial private bank job training programs. The program’s practical focus ensures students transition seamlessly into dynamic roles across India’s private banking sector.

Enrol today and step confidently into India’s fast-growing private banking industry with placement assurance and skill-based training.

FAQs

Private banks offer faster growth and higher starting salaries, while public banks ensure job security and long-term stability.

Yes, private banks generally offer higher performance-linked pay and faster salary increments.

Private banks provide quicker promotions and exposure to leadership roles based on merit.

Yes, with relevant skills and adaptability, professionals can transition between sectors.

Absolutely. Private banks promote equal opportunities, flexible roles, and leadership development for women professionals.