Private banking offers a variety of career options for fresh graduates and experienced professionals alike. From customer-facing roles to analytical and operational positions, there’s something for everyone. Understanding different private bank job roles helps you choose a career that suits your skills, interests, and long-term goals.

What are Private Sector Banking Careers?

Private sector banking careers involve working in non-government banks that focus on delivering innovative financial services and competitive products. These institutions hire for diverse private bank jobs, offering faster promotions and skill-based growth opportunities compared to some public sector roles.

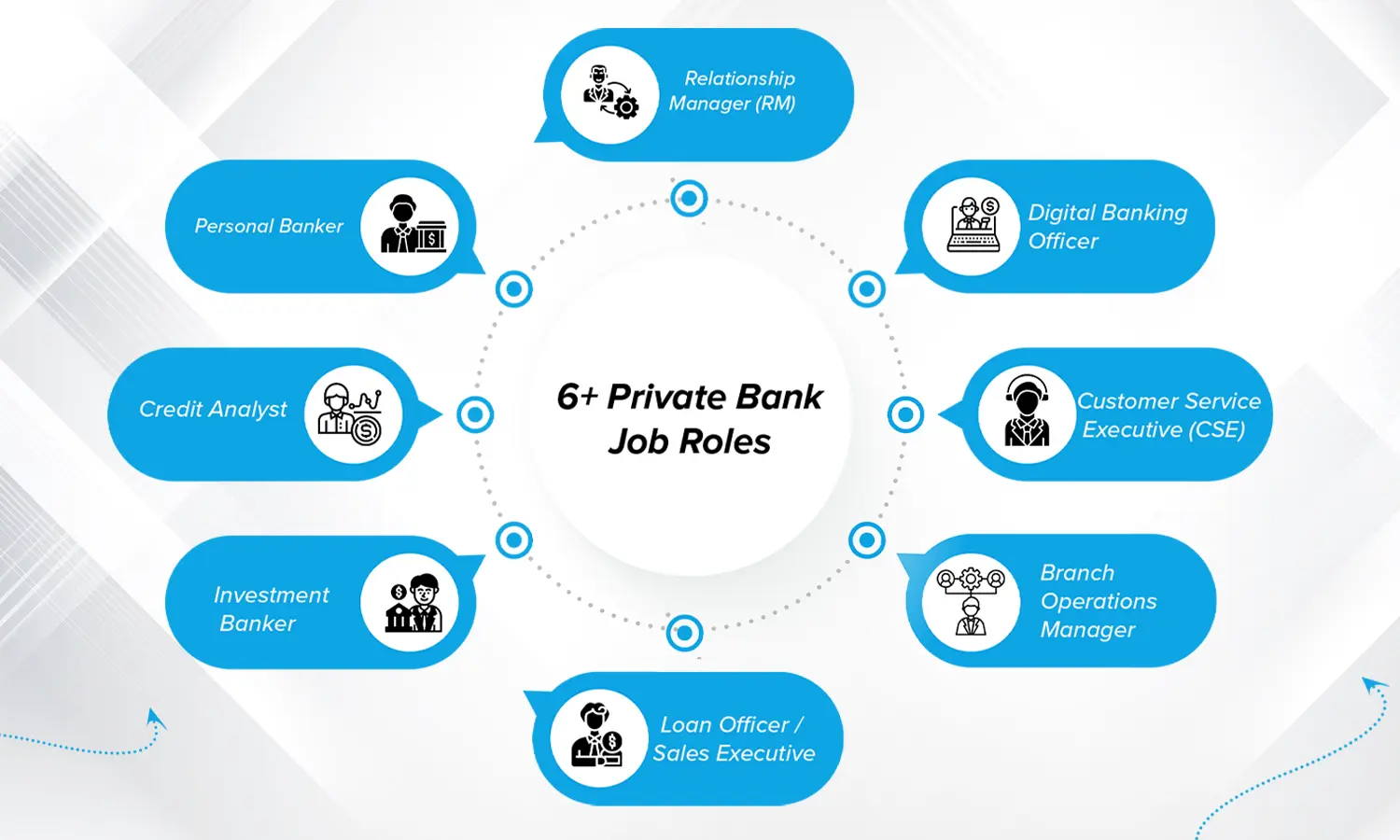

6+ Private Bank Job Roles

Below are the most in-demand private bank job roles and their key responsibilities.

1. Relationship Manager (RM)

A relationship manager role involves maintaining and expanding a portfolio of high-value customers, providing financial advice, and ensuring client satisfaction.

2. Personal Banker

Personal banker duties include handling day-to-day banking needs of customers, opening accounts, managing deposits, and cross-selling bank products.

3. Credit Analyst

A credit analyst job focuses on assessing loan applications, evaluating financial statements, and determining creditworthiness.

4. Investment Banker

An investment banking career includes raising capital for clients, managing mergers and acquisitions, and offering strategic financial advice.

5. Loan Officer / Sales Executive

Responsible for promoting loan products, meeting sales targets, and assisting customers through the application process.

6. Branch Operations Manager

Oversees branch operations, compliance, and service quality while managing staff and resources.

7. Customer Service Executive (CSE)

Handles customer queries, processes requests, and ensures timely resolution of complaints.

8. Digital Banking Officer

Manages private banking career path initiatives in online and mobile banking, ensuring seamless digital service delivery.

Skills and Qualifications Required for Each Bank Job

Most private sector banking jobs require a bachelor’s degree, strong communication skills, and a customer-oriented approach. Analytical ability, sales skills, and proficiency in banking software are also essential.

🎓 Looking to start your banking career? Apply today at SRM School of Banking! Enroll Now

How to Choose the Right Role Based on Your Strengths

Selecting the right position from the many private bank job roles depends on your interests and strengths:

- Good with people? Consider a relationship manager role or personal banker position.

- Enjoy analysis? Look at credit analyst or investment banking careers.

- Interested in technology? Explore opportunities as a digital banking officer.

Which Private Bank Offers the Best Career Growth?

Career growth in private banking depends on performance, skill upgrades, and networking. While promotions vary by institution, many private bank jobs offer faster advancement compared to the public sector, especially when paired with specialized training. SRM School of Banking enhances this journey by providing industry-focused training and private bank placement opportunities.

FAQs

Most private sector banking jobs require a bachelor’s degree in any discipline, with preferesalaries nce for finance, commerce, or business backgrounds.

While not mandatory, a professional banking course improves employability and job readiness.

Yes, many private banks recruit freshers through campus drives, job fairs, and placement agencies.

Entry-level salaries for private bank jobs start around ₹2.5–₹4 LPA plus incentives.

Apply through campus placements, job portals, or training institutes that offer placement support for private bank job roles.