Key Takeaways

- Private bank jobs offer faster career growth, performance-based rewards, and exposure to modern banking technologies.

- Completing a placement-assured banking program gives graduates the skills and confidence to clear interviews easily.

- SRM School of Banking (SRMSB) connects students directly with top private banks like HDFC, ICICI, and Axis for successful placements.

Why Choose Private Banking as a Career?

Private banking offers a dynamic and performance-oriented career path for fresh graduates. Unlike public sector banks, private banks reward ambition, offer faster promotions, and provide exposure to modern banking practices. Key advantages include:

- Quick Career Growth – Promotions and incentives are often performance-based.

- Exposure to Modern Banking – Work with digital platforms, fintech solutions, and innovative products.

- Customer-Facing Roles – Build relationships with clients and manage portfolios.

- Diverse Career Options – Opportunities in retail, corporate, wealth management, and credit analysis.

Graduates looking to start their BFSI careers without waiting for competitive exams often find private bank fresher jobs more accessible and rewarding.

Blockchain Technology and Its Impact on Banking Careers

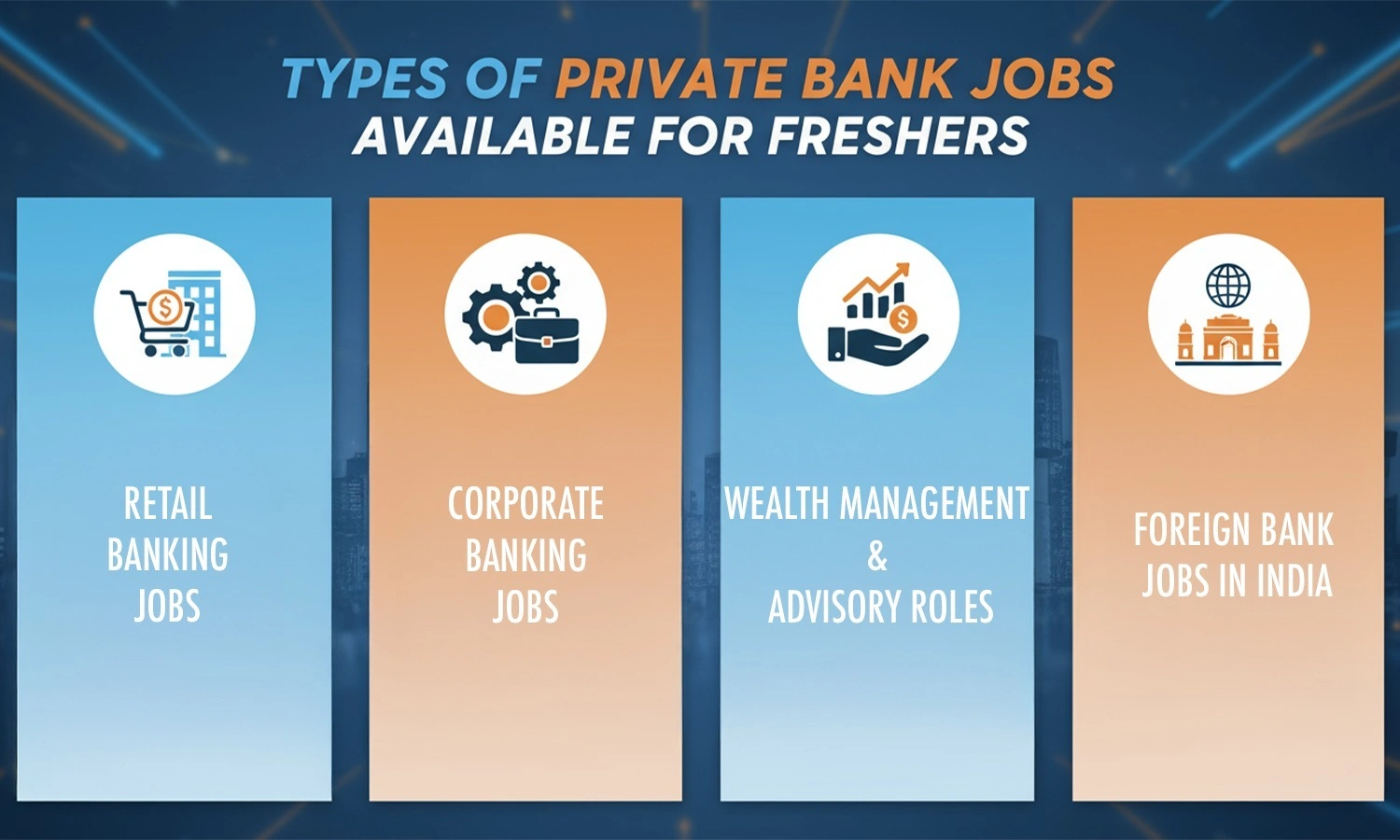

Private banks hire for a variety of entry-level positions, offering distinct career tracks:

- Retail Banking Jobs – Customer service officers, branch associates, and sales executives handling everyday banking operations.

- Corporate Banking Jobs – Credit analysts, relationship managers, and account managers dealing with business clients.

- Wealth Management & Advisory Roles – Assisting clients with investment, insurance, and portfolio management.

- Foreign Bank Jobs in India – Entry-level roles in multinational banks for exposure to global banking practices.

Each of these roles allows graduates to gain specialized experience and build private bank job skills that lead to long-term career growth.

Eligibility Criteria for Private Bank Jobs

While eligibility varies slightly by bank, the general criteria include:

- Educational Qualification – Bachelor’s degree in any discipline; commerce, finance, or management preferred.

- Age Limit – Typically 21–28 years for entry-level roles.

- Skills Required – Communication, numerical aptitude, customer service orientation, and basic digital literacy.

- Training Programs – Many banks prefer candidates who have completed structured private bank job training or banking courses with placement support.

Programs like SRM School of Banking equip candidates with practical knowledge, interview readiness, and technical exposure to meet these criteria.

Salary Packages Offered by Private Banks

Salary in private banks is competitive and often includes performance incentives:

- Entry-Level Banking Jobs – ₹2.5–3.5 LPA for freshers in customer service or branch roles.

- Relationship Managers & Corporate Banking Roles – ₹3.5–5.0 LPA initially, with commission or sales-linked bonuses.

- Wealth Management Associates & Specialized Roles – ₹4.0–6.0 LPA, with incentives based on portfolio growth.

Graduates who combine technical skills, communication proficiency, and digital banking expertise often secure higher private bank job salaries within the first year.

Want to know if you’re eligible for a banking career? 👉 Also read

Private Bank Hiring Process Explained

Private banks follow a structured recruitment process for freshers:

- Application & Shortlisting – Online application via bank portals or recruitment drives.

- Written Tests – Assessing numerical ability, reasoning, and general awareness.

- Group Discussion / Roleplay – Evaluating communication and client-handling skills.

- Personal Interview – Assessing fitment, motivation, and domain knowledge.

- Offer & Onboarding – Joining formalities and induction training programs.

Preparation through placement-assured banking programs significantly increases the chances of success.

Role of Training Programs in Private Bank Jobs

Structured training programs bridge the gap between academic knowledge and industry expectations:

- Practical Exposure – Hands-on learning in retail and corporate banking operations.

- Skill Development – Sales, customer handling, compliance, and digital banking training.

- Interview Preparation – Mock tests, group discussions, and HR interviews.

- Industry Insights – Understanding banking trends, products, and regulations.

Candidates completing such programs are preferred by banks because they are job-ready from day one.

How SRMSB Bridges Students with Private Bank Jobs

SRM School of Banking has established strong partnerships with leading private banks to provide assured placement support:

- Industry-aligned curriculum covering retail, corporate, and digital banking.

- Mock interviews, roleplays, and practical assignments to enhance readiness.

- Direct tie-ups with HDFC Bank, ICICI Bank, Axis Bank, Kotak, and other private banks.

- Dedicated guidance for women professionals and fresh graduates restarting their BFSI careers.

Ready to launch your banking career? Enroll now with SRMSB and step confidently into private bank jobs with the right skills, knowledge, and assured placement support!

FAQs

Complete a structured banking course, gain practical exposure, and apply through recruitment drives.

A bachelor’s degree in any discipline, commerce, finance, or management is preferred.

Yes, as long as candidates meet the eligibility criteria and have relevant skills.

HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank, and select foreign banks in India.