Rapid technological advancements, regulatory reforms, and evolving customer expectations are shaping the future of banking in India. From rural banking initiatives to blockchain integration, the Indian banking sector is undergoing a transformation that creates both challenges and opportunities. For graduates and professionals, understanding these trends is essential to prepare for upcoming roles in the BFSI industry.

Digital Transformation and FinTech Integration in Indian Banking

One of the most impactful shifts in the future of banking in India is the integration of digital platforms and fintech innovations. Digital banking in India has grown exponentially, with services like instant payments, AI-based customer support, and blockchain-enabled transactions improving speed and transparency.

The rise of fintech in India also means collaboration between banks and startups, opening new possibilities for service delivery and shaping the overall BFSI industry.

Rise of Contactless and Mobile Payments in the Future of Banking in India

The shift to online banking in India and contactless payments has accelerated since the pandemic. Mobile wallets, QR code payments, and UPI transactions are now standard, offering faster and more secure payment experiences. This trend aligns with the broader push for convenience, security, and user-friendly banking solutions in the Indian market.

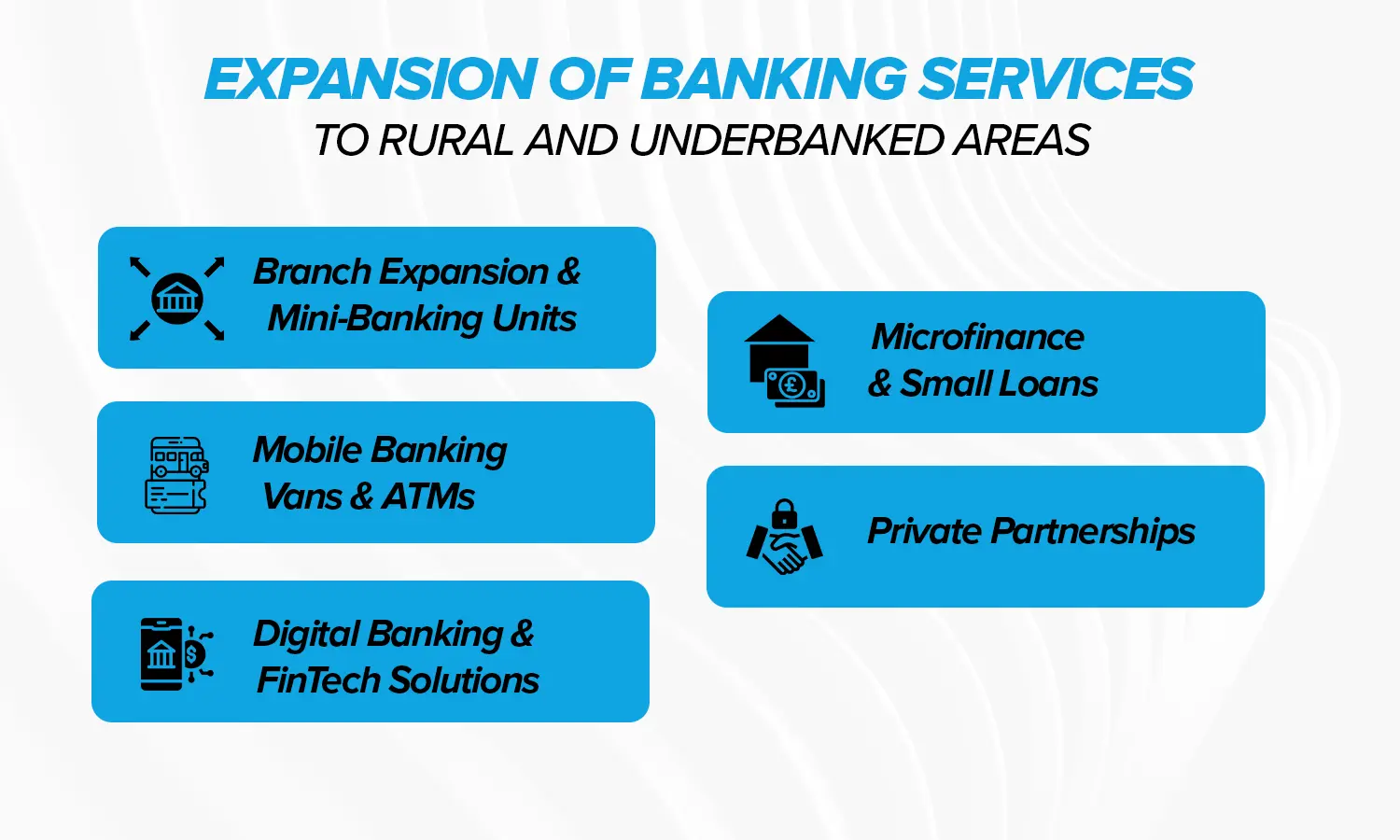

Expansion of Banking Services to Rural and Underbanked Areas

Financial inclusion is a core driver in the future of banking in India. Efforts include:

- Branch expansion & mini-banking units

- Mobile banking vans & ATMs

- Digital banking kiosks in remote areas

- Microfinance & small loans for entrepreneurs

- Private partnerships to extend reach

These initiatives bring the benefits of the formal financial system to millions, fueling Indian banking sector growth and improving economic participation.

Focus on Cybersecurity and Data Privacy in the Future of Banking in India

As digital adoption grows, protecting customer data becomes critical. Banks are investing heavily in encryption, AI-driven fraud detection, and blockchain-based security. For candidates preparing for banking jobs in India, understanding cybersecurity protocols is becoming as important as knowing traditional banking operations.

Changing Skill Requirements and Career Opportunities in Banking

The future of banking in India demands professionals with a mix of technical, analytical, and customer service skills. Knowledge of blockchain banking in India, data analytics, and digital compliance will be highly valued. This shift opens up new opportunities in future for those willing to adapt and upskill through industry-relevant programs like SRM School of Banking’s placement-assured courses.

FAQs

They will become more digital, customer-focused, and tech-driven, with services accessible anytime, anywhere.

Digital payments, AI-based customer service, blockchain integration, and mobile-first banking platforms.

It ensures equal access to financial services, boosts economic growth, and reduces income inequality.

Technical know-how in fintech tools, data analysis, cybersecurity awareness, and strong communication skills.