In the rising digital-first era, cybersecurity in banking is no longer optional; it is essential. With online banking, mobile transactions, and digital wallets becoming the norm, banks face increasing threats from hackers, phishing attacks, and financial fraud.

For graduates, this presents a golden opportunity: building a career at the intersection of finance and technology. At SRM School of Banking, where industry-relevant skills are emphasized, students are trained to meet these challenges and step into future-ready careers.

Why Cybersecurity is Critical in Banking

Banks safeguard not only money but also sensitive personal and financial data. Any breach can impact customer trust and result in heavy losses. This is why cybersecurity professionals play such a crucial role in ensuring secure digital transactions, protecting IT infrastructure, and complying with regulatory frameworks.

- Rising online transactions have made banks prime cyberattack targets.

- Fraud detection, encryption, and risk monitoring require specialized cybersecurity jobs.

- Protecting financial ecosystems ensures stability and customer confidence.

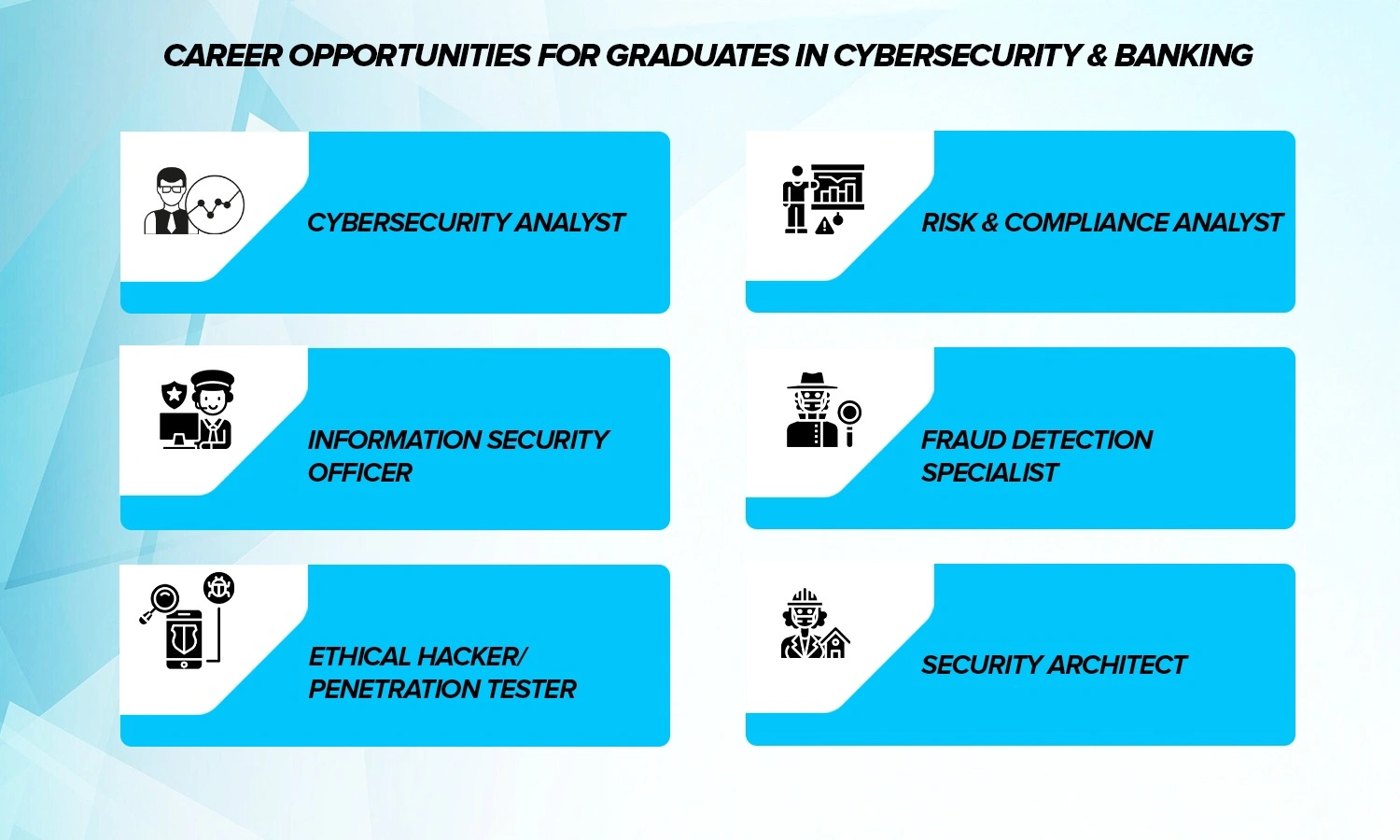

Career Opportunities for Graduates in Cybersecurity & Banking

Cybersecurity Analyst

A cybersecurity analyst monitors and defends banking systems against attacks. They identify vulnerabilities, respond to threats, and ensure security protocols are followed.

Information Security Officer

Responsible for designing and implementing policies, this role ensures regulatory compliance and oversees the protection of enterprise-wide data.

Ethical Hacker / Penetration Tester

These specialists simulate cyberattacks to test system strength, finding loopholes before hackers exploit them.

Risk & Compliance Analyst

Risk analysts in banking align security systems with compliance regulations, protecting banks from penalties while maintaining security.

Fraud Detection Specialist

With AI and machine learning tools, these professionals track suspicious patterns in real time, reducing the chances of financial fraud.

Security Architect

This senior role involves building strong security frameworks, integrating new technologies, and ensuring long-term resilience for banks.

Skills Required for a Cybersecurity Banking Career

Graduates aiming for cybersecurity jobs in banking must combine technical knowledge with problem-solving skills. Key skills include:

- Proficiency in network security, firewalls, and encryption tools.

- Understanding of financial systems and compliance frameworks.

- Knowledge of ethical hacking and penetration testing tools.

- Analytical thinking to detect and resolve vulnerabilities.

- Soft skills like communication and teamwork for cross-functional roles.

At SRM School of Banking, students are trained through a blend of technical and soft skills—ensuring they are ready to contribute from day one.

Future Scope of Cybersecurity in Banking

The scope of cybersecurity in banking is expanding rapidly as digital transformation accelerates. With rising cyber threats, the demand for cybersecurity professionals will only grow. Future opportunities will also span fintech startups, global financial institutions, and digital payment companies.

- AI-driven fraud detection and blockchain-based security will create new job roles.

- Global banking systems will need cybersecurity experts with cross-border compliance knowledge.

- For graduates, this field offers job security, global relevance, and strong salary growth.

With industry-aligned programs like SRM School of Banking’s, students gain the right foundation to thrive in this evolving space.

As digital banking becomes the backbone of financial services, cybersecurity in banking will define the industry’s resilience. For graduates, this is the perfect moment to explore career opportunities in risk management, ethical hacking, compliance, and fraud detection. With SRMSB’s focus on industry-driven training and placement support, students can confidently step into high-demand roles and build a career that secures the future of banking.

Future of BFSI Careers in the Age of AI

The future of BFSI careers lies in combining human intelligence with AI-driven systems. Banks will need professionals who understand both finance and technology. With placement-driven programs like those at SRMSB, graduates can stay ahead of the curve, prepared for dynamic roles in private banks and fintech organizations. AI won’t replace human jobs completely; instead, it will reshape them, creating smarter, faster, and more customer-focused banking careers.

FAQs

Yes, with proper training and skill development programs.

Both private and public banks actively recruit cybersecurity experts.

Basic coding knowledge helps, but is not always mandatory.

Yes, cybersecurity jobs in banking are in demand worldwide.