Key Takeaways

- The BFSI industry offers diverse entry-level roles with steady career progression.

- Freshers can earn competitive starting packages with performance-based incentives.

- Training from institutes like SRM School of Banking helps graduates secure placement-assured BFSI jobs.

The BFSI sector in India is booming in 2025, offering fresh graduates some of the most stable and rewarding career options. With rapid digitization and the expansion of private banks, opportunities are growing faster than ever. Whether you’re from commerce or another stream, the right banking course can open doors to top BFSI jobs with great salaries and career growth.

Why the BFSI Sector is a Top Career Choice in 2025

The Banking, Financial Services, and Insurance (BFSI) sector continues to be one of India’s fastest-growing industries in 2025. With private banks expanding aggressively and fintech companies disrupting traditional banking, the sector is creating thousands of new jobs at BFSI every year.

For fresh graduates, the BFSI industry offers:

- Diverse roles in banking, insurance, consulting, and financial services.

- Job stability due to the constant demand for financial professionals.

- Fast-track growth with structured training programs.

- Attractive salaries and performance-based incentives.

According to SRM School of Banking, BFSI careers are particularly rewarding for young professionals who want to enter a future-proof industry with long-term growth.

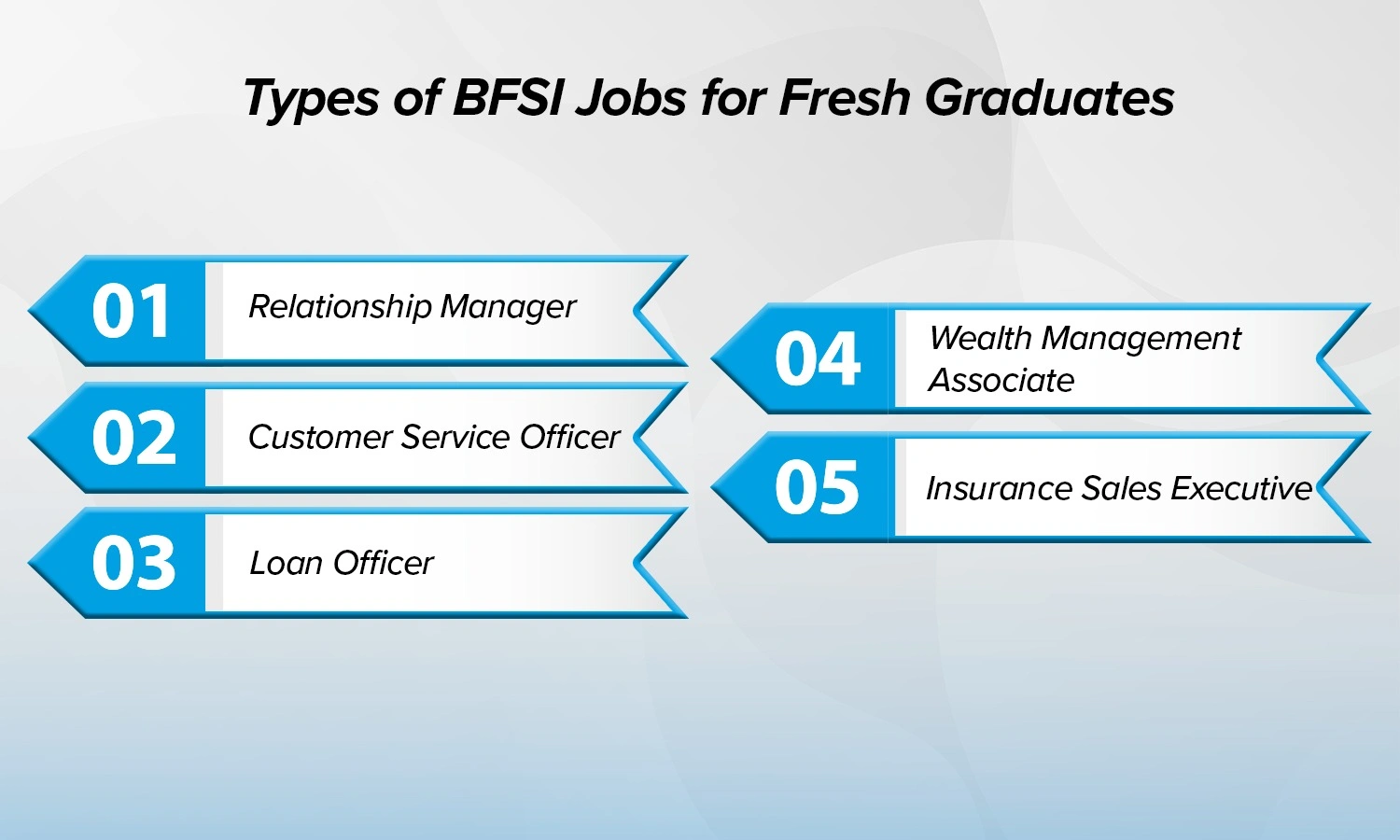

Types of BFSI Jobs for Fresh Graduates

The BFSI industry offers a variety of entry-level positions, each with a clear career path. Freshers completing a banking course from SRM School of Banking can explore opportunities such as:

Relationship Manager

- Acts as the bridge between the bank and its clients.

- Builds customer relationships, manages portfolios, and drives business growth.

Customer Service Officer

- Handles queries, complaints, and day-to-day banking support.

- Ensures smooth customer experience across digital and branch platforms.

Loan Officer

- Assesses credit applications, verifies documents, and approves loans.

- Plays a crucial role in retail and MSME lending growth.

Wealth Management Associate

- Assists senior advisors in investment and financial planning.

- Exposure to mutual funds, insurance, and portfolio management.

Insurance Sales Executive

- Promotes life, health, and general insurance products.

- A performance-driven role with strong earning potential.

These BFSI jobs for freshers ensure that graduates start with solid industry exposure and develop essential banking skills from day one.

Entry-Level Salary Expectations in the BFSI Sector

One of the biggest attractions for graduates is the salary structure in BFSI jobs. In 2025, the sector continues to offer competitive packages with opportunities for incentives and bonuses.

- BFSI salary for freshers: ₹2.5 – ₹4.5 LPA depending on role and bank.

- Relationship Managers & Loan Officers: ₹3.2 – ₹4.5 LPA.

- Customer Service Officers & Insurance Executives: ₹2.5 – ₹3.5 LPA.

- Wealth Management Associates: ₹3.5 – ₹4.8 LPA with incentives.

Incentives and sales-linked bonuses often double the earnings within the first year. Graduates who upskill quickly can move into mid-level BFSI sector jobs with ₹6–8 LPA salaries within 3–4 years.

SRM School of Banking’s placement-assured course ensures students don’t just find jobs, but secure stable, high-growth careers.

Key Skills That Boost Your BFSI Salary

Employers in the BFSI sector look beyond degrees; they want professionals with the right mix of technical, analytical, and soft skills.

Key skills that help freshers stand out include:

- Communication & Customer Handling – crucial for client-facing roles.

- Sales Skills – for relationship management and insurance careers.

- Financial & Digital Literacy – understanding digital banking platforms.

- Risk Awareness – recognizing fraud and compliance challenges.

- Problem-Solving Ability – finding solutions in real-time customer interactions.

Graduates trained in digital banking training and equipped with practical exposure during the course often command better starting salaries than untrained peers.

How SRM School of Banking Prepares You for BFSI Jobs

SRM School of Banking has established itself as a trusted pathway for graduates entering the BFSI sector. The institute offers industry-aligned banking and finance courses with a 100% placement guarantee.

Here’s how SRMSB prepares students for success:

- Structured Curriculum: Covers retail banking, finance, insurance, and digital banking.

- Practical Training: Mock interviews, roleplays, and case studies.

- Skill Development: Focus on sales, communication, and customer handling.

- Placement Assistance: Direct tie-ups with HDFC Bank, ICICI Bank, Axis Bank, Kotak, and top insurance companies.

- Women-Focused Training: Dedicated support for women professionals restarting careers.

With SRMSB, students graduate with job-ready skills and guaranteed entry into private bank careers. To know more about SRM School of Banking, Enquire now!

FAQs

₹2.5–4.5 LPA depending on role and bank.

Yes, with clear paths to mid and senior-level roles.

Yes, training programs make it accessible for all graduates.

It refers to financial loss due to credit, market, or operational failures.

Yes, it offers 100% assured placements in top banks and financial firms.