Key Takeaways

- A banking resume should clearly highlight your career objective, practical skills, and readiness for BFSI roles, especially if you’re a fresher.

- Using ATS-friendly banking keywords like “retail banking,” “customer service,” and “financial products” ensures your resume gets noticed by recruiters.

- Completing a placement-assured banking program helps you gain real-world exposure and build a professional resume that stands out in private bank hiring.

How to Write a Strong Career Objective for Banking Jobs

A well-crafted career objective immediately grabs the recruiter’s attention. For fresh graduates entering the BFSI sector, it should be concise, relevant, and demonstrate ambition:

- Be Specific – Mention the role you are targeting, e.g., Customer Service Officer or Relationship Manager.

- Highlight Skills – Include core banking skills, communication, and problem-solving.

- Show Career Goals – Reflect commitment to professional growth within the banking sector.

Example:

“Seeking a challenging role as a Relationship Manager in a reputed bank to leverage my analytical and communication skills while contributing to client growth and organizational success.”

A strong career objective sets the tone for your banking resume, ensuring it resonates with hiring managers.

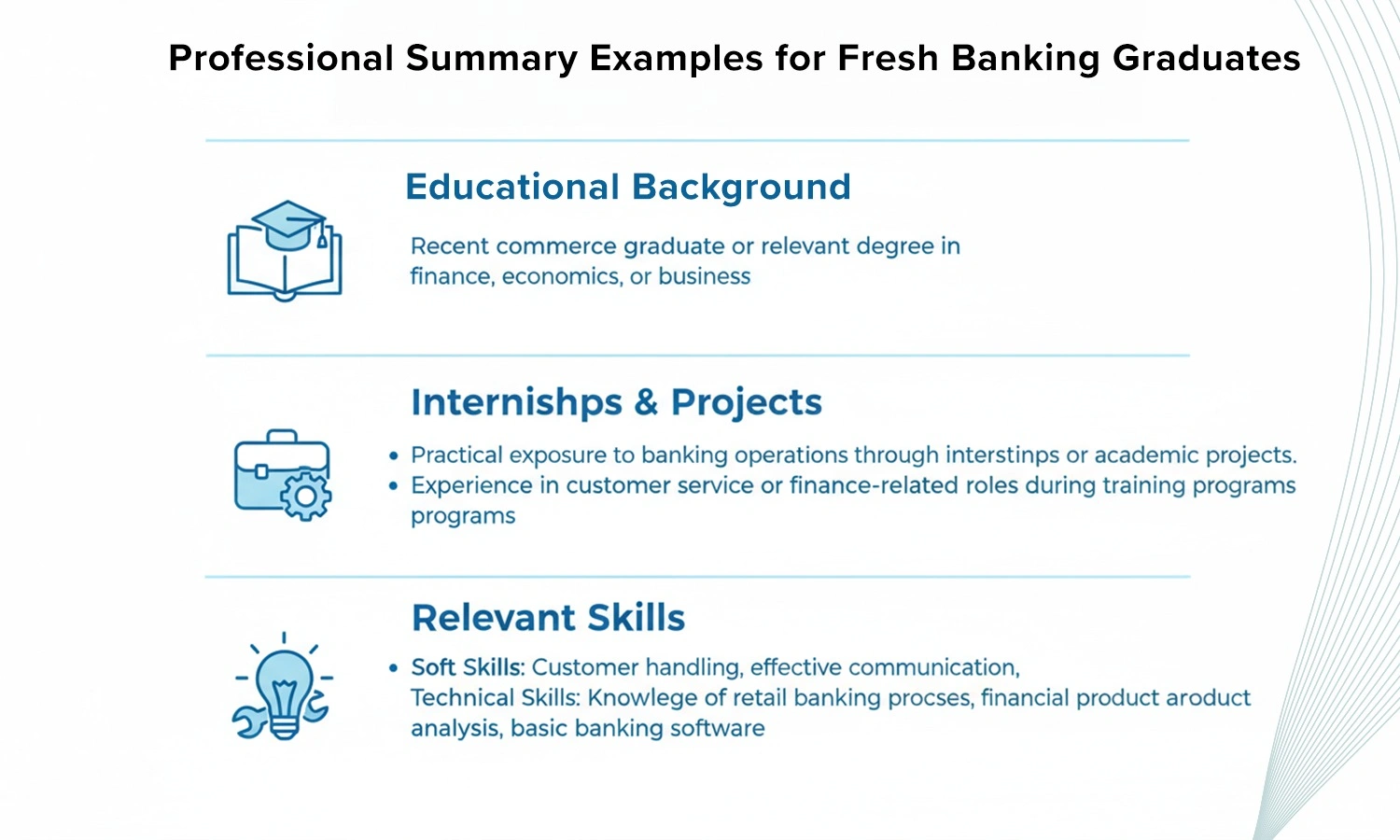

Professional Summary Examples for Fresh Banking Graduates

For freshers with limited experience, a professional summary highlights academic achievements, internships, and relevant skills:

- Mention your educational background and certifications.

- Highlight any internships or projects in banking, finance, or BFSI training programs.

- Include soft and technical skills relevant to banking operations.

Example:

“Recent commerce graduate with practical exposure to digital banking operations through SRM School of Banking’s placement-assured program. Skilled in customer handling, retail banking, and financial product analysis.”

A professional summary provides a snapshot of your readiness for BFSI jobs and helps recruiters quickly assess suitability.

Must-Have Skills to Include in a Fresher Banking Resume

Employers look for a mix of technical and soft skills. Including these ensures your resume stands out:

- Technical Skills: Digital banking platforms, MS Excel, and financial calculations.

- Soft Skills: Communication, client handling, problem-solving, and teamwork.

- Sales & Relationship Skills: Essential for roles in retail banking and insurance.

- Risk Awareness: Basic understanding of compliance, fraud, and KYC norms.

By listing these skills for banking resume, freshers demonstrate they are job-ready from day one.

Banking-Specific Keywords to Make Your Resume ATS-Friendly

Many banks use Applicant Tracking Systems (ATS) to filter resumes. Including banking-specific keywords ensures your resume reaches recruiters:

- Retail banking, corporate banking, loan processing, and financial products

- Customer service, relationship management, compliance, KYC

- Digital banking, wealth management, and insurance sales

- Risk management, portfolio management, and client handling

Using these keywords naturally in your resume increases the chance of clearing initial ATS screenings.

Ideal Resume Format for Banking Job Applications

A clean, professional resume format is crucial:

- Header : Name, contact information, LinkedIn profile.

- Career Objective : 2–3 concise sentences.

- Education & Certifications : Degree, BFSI courses, and relevant certifications.

- Skills Section : Technical and soft skills tailored for banking roles.

- Professional Exposure/Internships : Any banking projects or training programs.

- Awards/Extra-Curriculars : Leadership roles or achievements relevant to banking.

Tip: Stick to a 1-page PDF format for freshers. This ensures clarity and professionalism.

Common Resume Mistakes Freshers Make and How to Avoid Them

Freshers often make errors that reduce their chances of selection. Avoid these:

- Using generic career objectives unrelated to banking.

- Overloading the resume with irrelevant information.

- Ignoring ATS optimization – skip banking-specific keywords at your peril.

- Using an unprofessional format – cluttered layouts confuse recruiters.

- Including incorrect or exaggerated information – maintain honesty.

Following these tips ensures your fresher resume with no experience is impactful and recruiter-friendly.

Want to build a job-winning banking resume and career? Enroll now with SRM School of Banking (SRMSB) and get guided resume support, interview training, and placement in top private banks.

FAQs

Complete a structured banking course, gain practical exposure, and apply through recruitment drives.

A bachelor’s degree in any discipline, commerce, finance, or management is preferred.

Yes, as long as candidates meet the eligibility criteria and have relevant skills.

HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank, and select foreign banks in India.