The Indian banking sector is witnessing unprecedented growth, making banking-related courses increasingly popular.

- With the expansion of private banks, fintech innovations, and digital banking adoption, skilled professionals are in high demand.

- Enrolling in a banking course with placement ensures graduates gain industry-aligned skills, including customer handling, retail banking operations, risk management, and digital banking exposure.

- BFSI jobs in India offer attractive entry-level salaries, rapid career growth, and stability, making these courses a strategic choice for aspirants.

Institutions like SRM School of Banking provide structured bank training and placement, bridging the gap between academic knowledge and industry requirements.

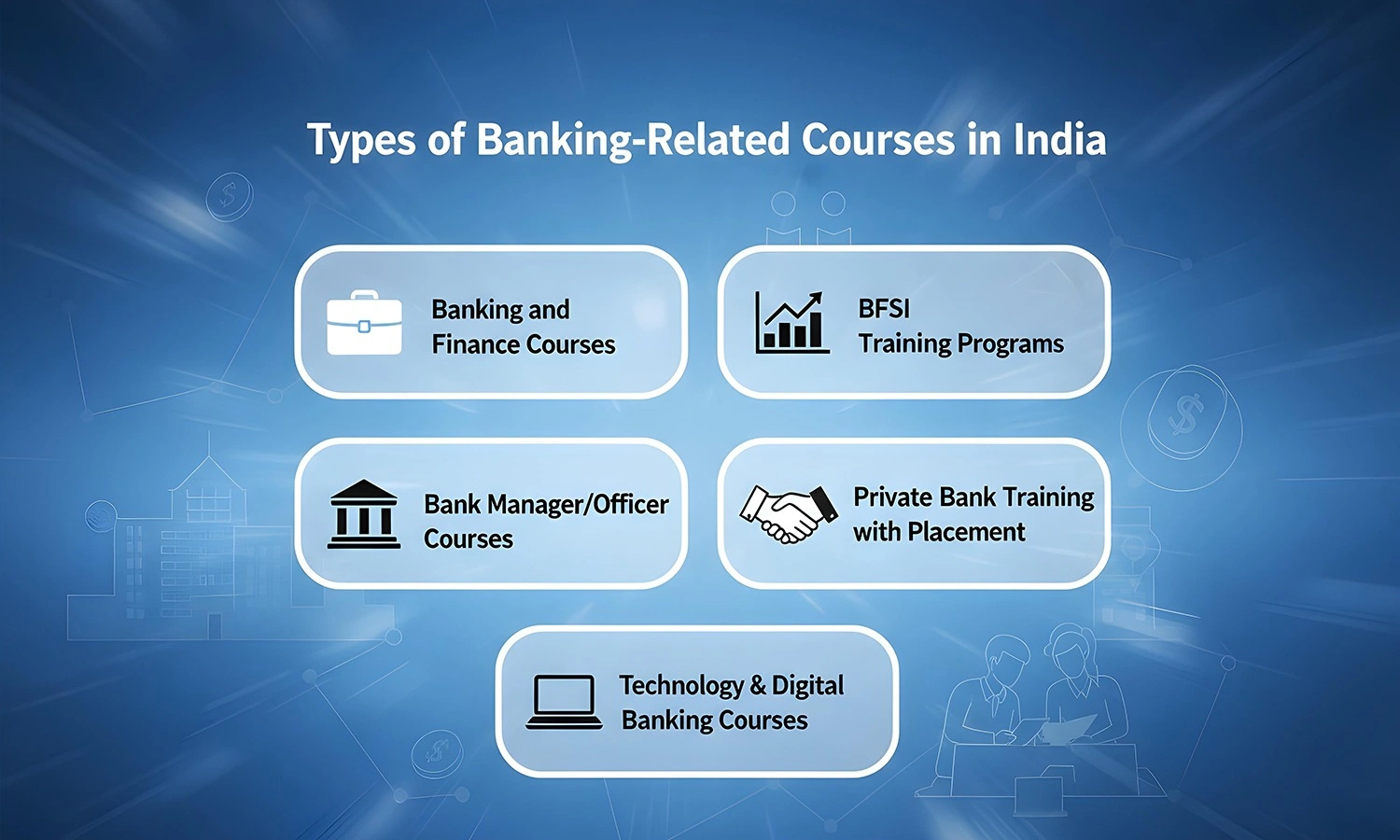

Types of Banking-Related Courses in India

Banking aspirants can choose from a wide variety of banking-related courses in India, each tailored to different career goals. These include:

- Banking and Finance Courses – Focus on retail banking, financial services, and insurance fundamentals.

- BFSI Training Programs – Comprehensive programs designed to prepare candidates for private bank careers and BFSI consulting jobs.

- Bank Manager/Officer Courses – Leadership-focused courses aimed at supervisory roles in branch operations.

- Private Bank Training with Placement – Short-term, performance-oriented programs with direct industry tie-ups.

- Technology & Digital Banking Courses – Cover digital banking, cybersecurity, payment platforms, and fintech innovations.

Each course type offers specialized skills, ensuring graduates are job-ready and competitive in the evolving banking sector.

Best Banking Courses After Graduation (With Placement Options)

Graduates looking to start a banking career have several options. Banking-related courses after graduation at SRM School of Banking provide practical exposure through:

- Mock interviews, roleplays, and real-time case studies.

- Training in customer handling, digital banking, and compliance.

- Access to top private banks like HDFC, ICICI, Axis, and Kotak for placement.

Such courses ensure students not only learn theory but also gain confidence to step directly into BFSI jobs. Programs typically last 3–6 months and include assured placement support.

How to Choose the Right Banking Course for Your Career Goals

Selecting the right banking-related course depends on:

- Career Focus – Decide if you want retail banking, insurance, BFSI consulting, or fintech roles.

- Placement Support – Courses with direct industry tie-ups help secure jobs faster.

- Duration & Flexibility – Online, offline, or hybrid modes may suit working professionals differently.

- Skill Development – Look for programs that include soft skills, digital banking, and customer handling.

SRM School of Banking ensures its programs align with aspirants’ goals, offering both practical exposure and bank training and placement support.

Top Institutes Offering Banking Courses in India (With SRMSB Advantage)

While India has multiple institutions offering banking-related courses, SRM School of Banking stands out for its industry-aligned curriculum, short-duration programs, and 100% placement support. Key advantages include:

- Direct tie-ups with private banks and BFSI companies.

- Practical training with mock interviews and real-life banking simulations.

- Focus on women professionals and non-commerce students.

- Affordable fees with high ROI due to placement assurance.

Graduates from SRMSB can quickly transition into roles like Relationship Manager, Customer Service Officer, Loan Officer, or BFSI consulting positions.

Secure your banking future — apply now with SRMSB’s placement-assured program!

FAQs

Courses with industry-aligned curriculum and placement support, like SRMSB’s programs.

Graduates from any discipline can enroll in BFSI-focused banking courses.

₹2.5–4.5 LPA for entry-level roles, with incentives and performance bonuses.

Yes, every program includes 100% placement assistance with top banks.