A banking career in India offers stability, growth, and opportunities across multiple roles in both banks and NBFCs. With the right skills and preparation, you can move from being a graduate to a trained banking professional in just a few months. This guide breaks down the process into 7 simple steps to help you start and succeed in your banking journey.

Why Choose a Banking Career in India?

Banking remains one of the most trusted career options due to job security, professional growth, and attractive pay packages. The career growth in banking is structured, allowing professionals to move from entry-level roles to managerial positions over time. However, understanding the challenges in banking — like high targets and regulatory compliance — is equally important before starting.

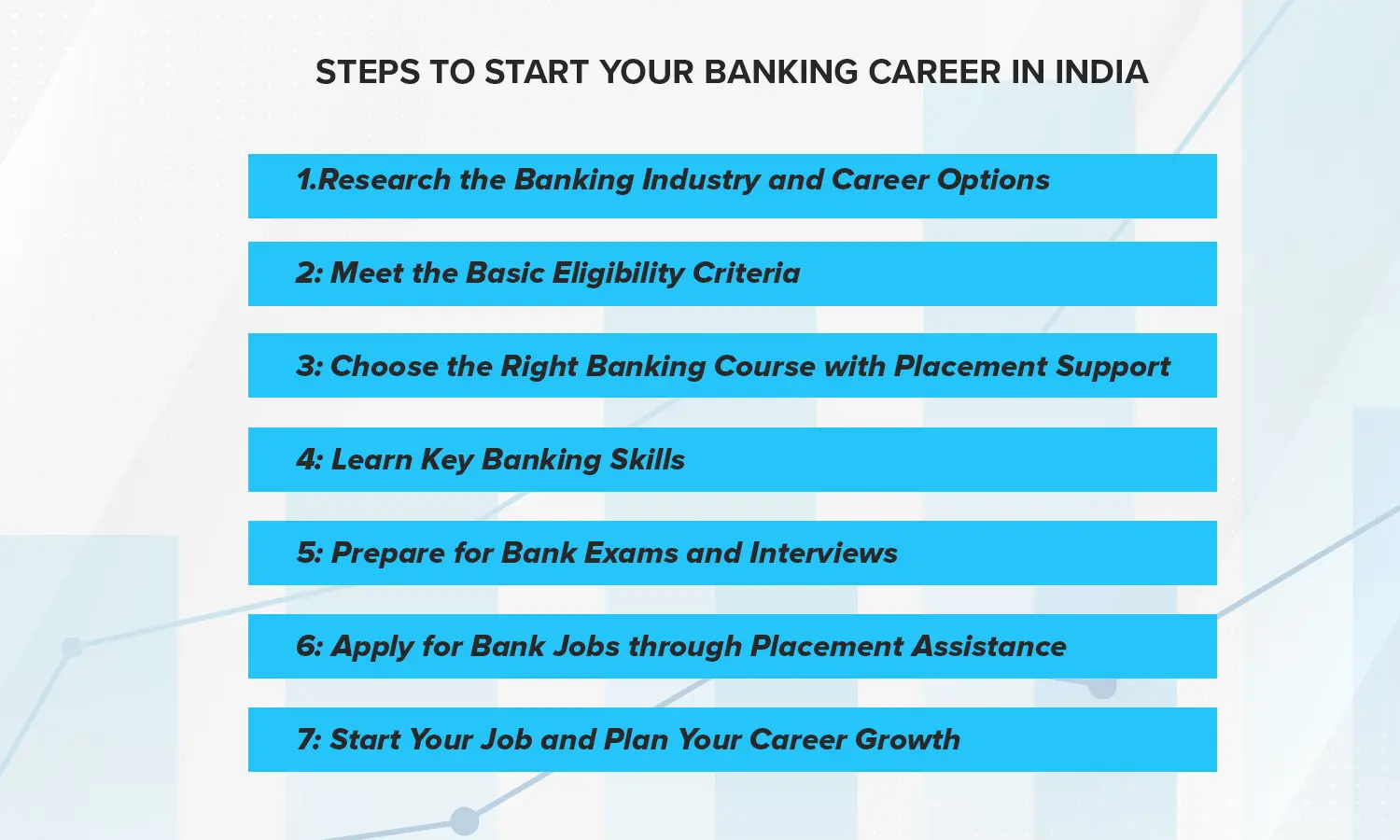

Steps to Start Your Banking Career in India

Below are the most in-demand private bank job roles and their key responsibilities.

Step 1: Research the Banking Industry and Career Options

Before entering the sector, explore various banking career paths such as retail banking, wealth management, credit analysis, or operations. Understanding these options will help you choose the right role and training program.

Step 2: Meet the Basic Eligibility Criteria

Check the eligibility for bank jobs — usually a graduate degree, minimum age of 20, and good communication skills. Some roles may require specific subject knowledge or computer proficiency.

Step 3: Choose the Right Banking Course with Placement Support

Enrolling in a course that combines technical training with placement assistance is key. SRM School of Banking offers a placement-assured program to help you secure a role quickly.

Step 4: Learn Key Banking Skills

Focus on skills like customer handling, financial product knowledge, regulatory compliance, and digital banking tools. Strong communication and numerical ability are essential in a banking career in India.

Step 5: Prepare for Bank Exams and Interviews

Written tests and interviews remain standard in the hiring process. Structured coaching can help you prepare efficiently, covering reasoning, aptitude, and industry awareness.

Step 6: Apply for Bank Jobs through Placement Assistance

Leverage institutional placement drives, referrals, and direct applications to get your first role. SRM’s network helps connect graduates with private banks.

🎓 Looking to start your banking career? Apply today at SRM School of Banking! Enroll Now

Step 7: Start Your Job and Plan Your Career Growth

Once employed, focus on continuous learning to advance your career growth in banking. Certifications, on-the-job training, and performance can accelerate promotions.

How to Choose Your Career Path?

When mapping your banking career path, consider your strengths, preferred work style, and long-term goals. Whether it’s client-facing roles or analytical positions, aligning your career choice with your skills ensures job satisfaction and growth. At SRM School of Banking, we guide you to identify your strengths and match them with the right banking roles, ensuring a smooth transition from learning to placement.

FAQs

A graduate degree in any stream is typically required.

With structured training and placement support, many candidates secure jobs within 3–6 months.

Freshers can expect ₹2.5–₹4 LPA plus incentives, depending on the role and institution.

Choose a relevant course, develop essential skills, prepare for assessments, and use placement support to enter the industry.