Key Takeaways

Banking aspirants can choose from a wide variety of banking-related courses in India, each tailored to different career goals. These include:

- A bank manager course prepares graduates for leadership roles by developing their technical and managerial skills.

- The course covers finance, operations, customer management, and digital banking, all crucial for today’s private banks.

- With SRM School of Banking’s placement-focused training, students can step directly into promising careers in India’s BFSI sector.

Why Bank Manager Courses are in High Demand in India

India’s banking sector is expanding rapidly, with private banks opening new branches and launching digital banking platforms nationwide. This has created a high demand for trained professionals who can manage operations, teams, and customer relationships efficiently.

A bank manager course equips students with both the technical and leadership capabilities needed for such roles. Unlike general degrees, these courses focus on real-world applications, teaching you to handle branch operations, manage teams, and meet business targets while maintaining compliance and service quality.

With rising expectations in financial management and customer service, banking and finance courses that focus on managerial excellence have become the go-to path for ambitious graduates.

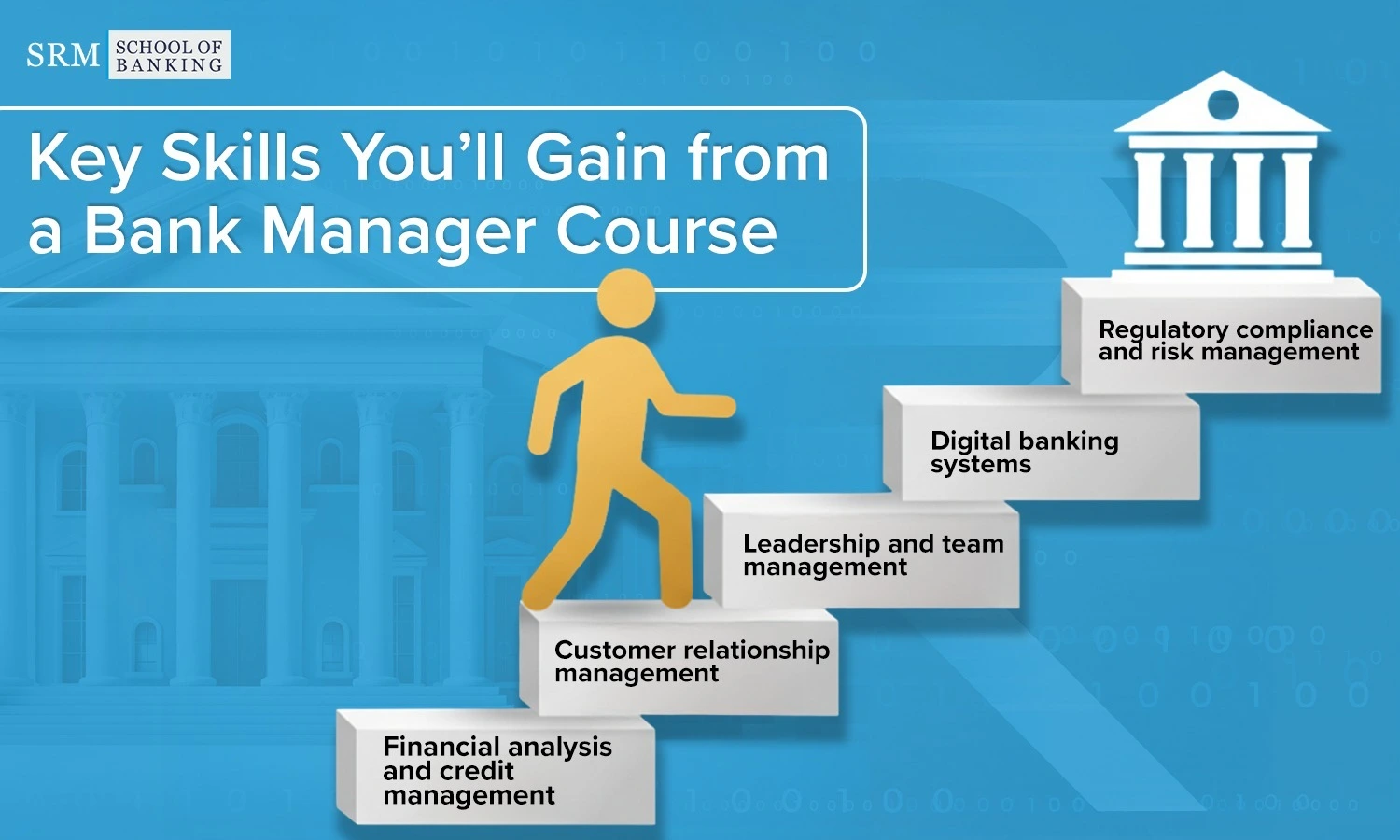

Key Skills You’ll Gain from a Bank Manager Course

Completing a bank manager course helps you develop a strong mix of analytical, operational, and interpersonal skills essential for success in the BFSI sector. You’ll learn:

- Financial analysis and credit management for evaluating loans and investments

- Customer relationship management to build trust and ensure retention

- Leadership and team management for branch performance optimization

- Digital banking systems need to stay updated with evolving fintech tools

- Regulatory compliance and risk management to ensure smooth, lawful operations

These skills not only make you job-ready but also prepare you to move into senior roles faster.

Eligibility Criteria to Enroll in a Bank Manager Course

To apply for a bank manager course, candidates must typically meet these requirements:

- A graduate degree in commerce, economics, finance, or a related discipline

- Basic understanding of accounting principles and communication skills

- Some institutions prefer candidates with prior work experience, though freshers are equally welcome

Professional training institutes like SRM School of Banking (SRMSB) also accept final-year students aspiring to enter the BFSI sector, providing a bridge from academic learning to professional growth.

Bank Manager Course Duration & Curriculum Breakdown

The banking course banking course duration generally ranges between 6 months to 1 year, depending on whether it’s a certificate or diploma-level program.

The banking course syllabus is designed to provide a 360° understanding of the banking ecosystem, including:

- Principles of Banking & Finance

- Loan Processing & Credit Evaluation

- Retail & Corporate Banking

- Digital & Core Banking Operations

- Leadership and Performance Management

- Business Ethics & Customer Handling

These modules are taught through case studies, simulations, and live banking projects, ensuring students are well-prepared for on-the-job challenges.

Career Growth & Salary After Completing a Bank Manager Course

After completing a banking course with placement, students can start in roles like Assistant Manager, Operations Executive, or Relationship Officer, depending on their specialization. With experience, they can rise to Branch Manager or Regional Manager positions.

The average starting salary for graduates in managerial-track programs ranges between ₹4–6 LPA, with mid-level professionals earning up to ₹12–18 LPA. Strong performance, customer engagement, and leadership skills can accelerate promotions and salary growth significantly.

This upward mobility makes bank manager courses one of the best career investments in the banking domain today.

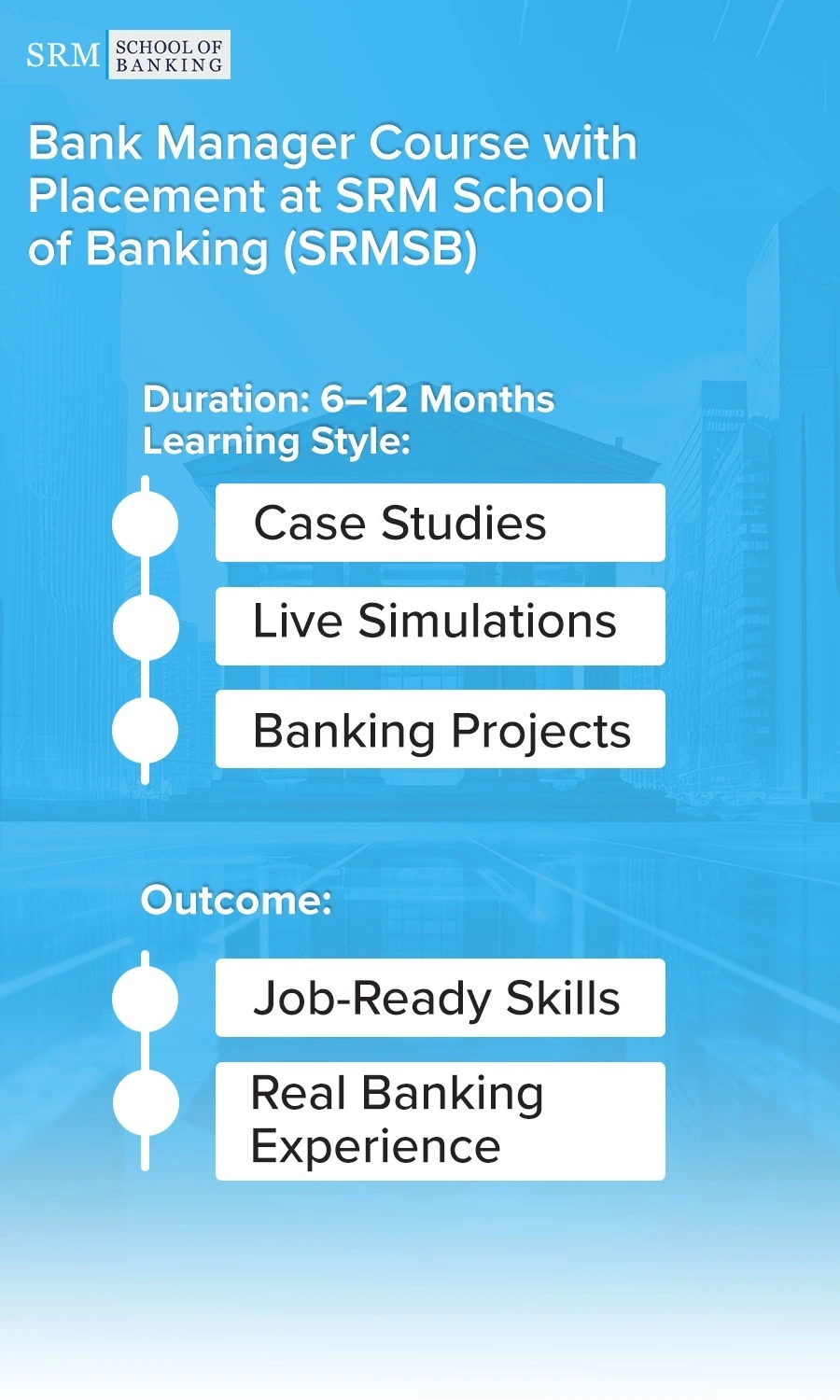

Bank Manager Course with Placement at SRM School of Banking (SRMSB)

The SRM School of Banking (SRMSB) offers one of India’s most comprehensive bank manager courses with placement. Designed by industry experts, the program blends academic rigor with real-world banking exposure.

Here’s what sets SRM apart:

- Placement assured course with partnerships across top private banks

- Curriculum aligned with industry standards and BFSI best practices

- Live projects and simulation labs to develop applied banking experience

- Continuous mentorship from banking professionals and placement experts

With SRM’s hands-on training, students don’t just learn banking — they live the experience, gaining the creonfidence and competence needed to excel as future bank managers for placement-assured training at SRMSB. Enroll Today

FAQs

It generally takes 5–7 years of progressive experience after completing a professional bank manager course.

The SRM School of Banking offers a recognized placement-focused program designed for managerial-track banking roles.

Graduates can work as Assistant Managers, Branch Managers, or Credit Officers in private and corporate banking sectors.