Key Takeaways

- The bankers program prepares graduates for immediate roles in India’s BFSI industry.

- A structured banking training program builds both technical and soft skills essential for success.

- SRM School of Banking’s placement-assured banking program guarantees direct access to private bank fresher jobs.

- Each banking career program blends classroom training with practical exposure.

- The job-oriented banker training model ensures employability, confidence, and long-term growth.

Starting a career in banking can feel uncertain for fresh graduates entering the competitive BFSI industry. That’s why enrolling in a banker’s program is one of the smartest choices you can make. It equips you with the right blend of theoretical knowledge and practical experience that

Why Fresh Graduates Need Specialized Banker Programs

The BFSI sector thrives on skilled professionals who can adapt quickly. A banker’s program provides that edge by offering focused modules on financial operations, customer relations, and digital systems. Unlike general degrees, it’s tailored for graduates who want to secure immediate roles in banking.

SRM School of Banking ensures students learn essential skills—communication, compliance, and sales strategies- through an engaging banking career program that aligns perfectly with industry standards. It’s an opportunity for freshers to step into the workforce fully equipped, confident, and placement-ready.

Difference Between Banker’s Program & MBA

While an MBA provides a broad view of management, a bankers program dives deep into the specifics of retail, corporate, and digital banking. An MBA often requires two years of study, while a job-oriented banker training course typically lasts a few months but delivers direct employability.

The focus is on practical learning, not theory. Graduates from SRMSB’s banking course gain exposure to real-world banking processes, mock interviews, and customer handling skills, making them ideal candidates for immediate BFSI roles.

Duration and Placement Process in a Banker’s Training

The bankers program at SRM School of Banking is a short-term, skill-driven banking training program that runs for three to six months.

It equips students with core banking operations, compliance, and customer service skills through practical sessions and case-based learning. The structured banking career program concludes with mock interviews and real-time exposure to ensure job readiness.

Backed by direct industry tie-ups, learners gain access to private bank fresher jobs, making this job-oriented banker training ideal for graduates aiming for quick placements through an expertly designed banking course with guaranteed outcomes.

Job Roles Offered After Completion of the Banking Program

Graduates completing a banker’s program can enter multiple BFSI roles, including customer service, relationship management, credit operations, and wealth management. These roles form the foundation of every modern banking setup.

SRM School of Banking ensures that every learner is guided towards roles that match their skills and career goals. With its placement-focused training and mentorship, students can build long-term careers in top financial institutions.

Salary Expectations for Trained Bankers

Freshers who complete a bankers program often start with salaries ranging from ₹2.5 to ₹3.5 LPA in entry-level positions. Roles such as Relationship Manager or Loan Officer can reach ₹4.5 LPA with incentives.

Thanks to the strong placement network at SRM School of Banking, learners benefit from early employment opportunities and steady career progression, achieving higher earning potential over time.

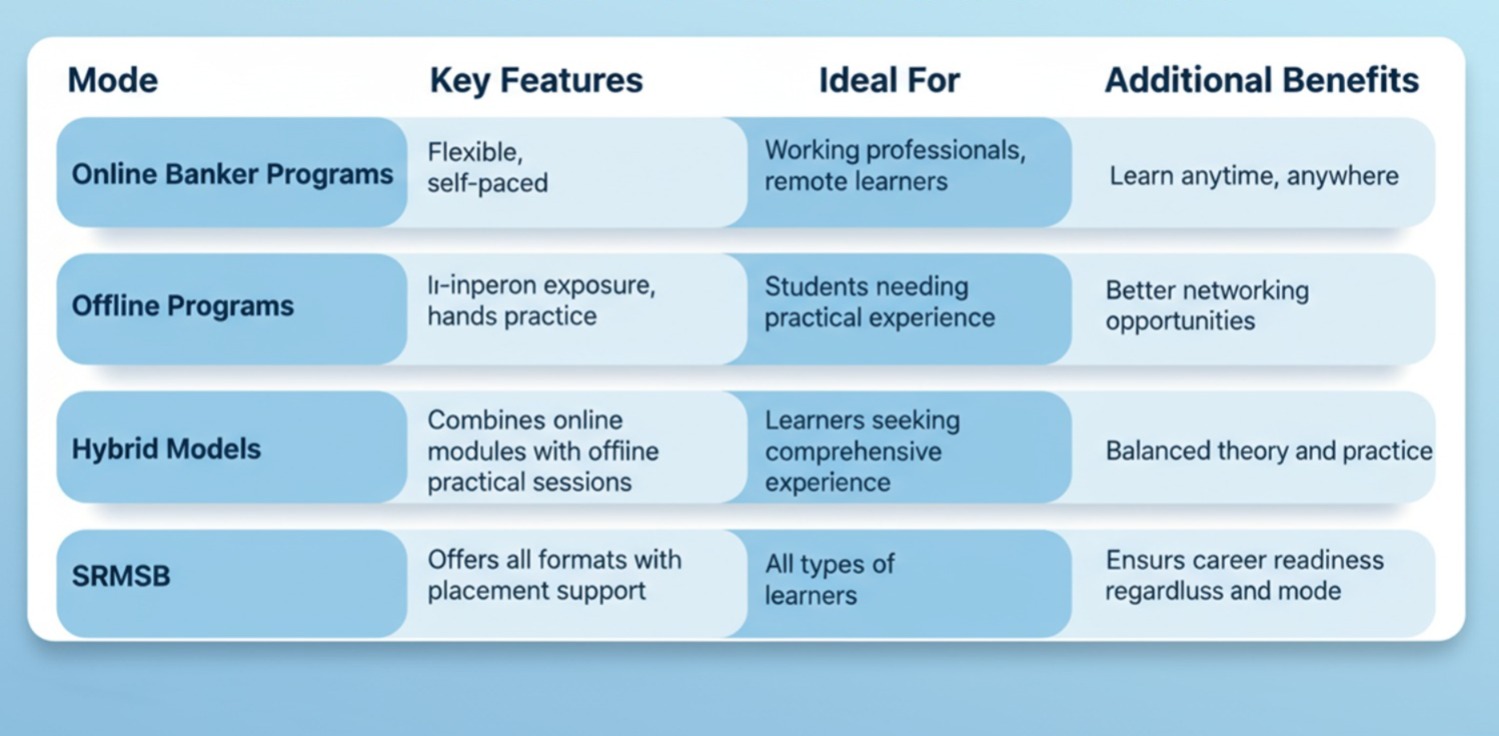

Online vs Offline Banker Programs

Every learner has unique needs, and SRMSB caters to them all.

- Online Banker Programs: Self-paced and flexible, perfect for working professionals and remote learners.

- Offline Programs: Offer hands-on practice, classroom engagement, and networking opportunities.

- Hybrid Models: Combine digital flexibility with in-person learning for complete exposure.

SRM School of Banking offers all three formats, ensuring its bankers program remains accessible and career-focused for every learner.

How SRMSB Fast-Tracks Careers with Its Placement-Assured Banking Program

SRM School of Banking accelerates career growth through its placement-assured bankers program, blending classroom learning with on-ground exposure. The placement assured banking program ensures every student receives personalized guidance and mentorship from experienced bankers. Its industry-focused curriculum and banking training program prepare learners for roles in top private banks. With partnerships across major institutions, this banking career program offers assured placement support and real-time learning. SRMSB’s job-oriented banker training model builds confidence and competence, ensuring graduates complete the banking course ready for stable, rewarding roles in India’s leading financial institutions.

Enroll now in the Placement-Assured Banking Program and step confidently into your dream job with India’s top private banks. Start your journey to a successful BFSI career today!

FAQs

A bankers program is a short-term, practical course that prepares graduates for various roles in the BFSI sector through skill-based training and real-world learning.

Any graduate, preferably from commerce or finance backgrounds, can enroll. However, SRMSB welcomes learners from all streams interested in banking careers.

Students learn digital banking operations, financial compliance, communication, sales, and customer relationship management skills through the banking training program.

The best choice is a placement assured banking program that guarantees practical learning and employment support—like SRM School of Banking’s trusted bankers program.