Key Takeaways

- BFSI training for freshers builds job-ready skills for immediate placement in banks.

- Hands-on learning and mock interviews boost confidence and employability.

- The BFSI training course ensures fast-track entry into banking sector jobs.

- SRM School of Banking’s placement-assured program connects graduates directly to top recruiters.

The BFSI training program is designed to make fresh graduates job-ready for the banking and finance sector. It blends practical exposure with essential BFSI skills training to help learners excel in real-world roles. Through SRM School of Banking’s BFSI course with placement, students gain both technical expertise and soft skills needed to succeed in top banking course careers.

What is BFSI Training and Why It Matters for Freshers

BFSI training is a structured program designed to prepare graduates for jobs in the Banking, Financial Services, and Insurance sector. Unlike traditional banking courses, this training focuses on practical learning and industry exposure.

It helps freshers master digital banking, compliance, and customer engagement while boosting communication and confidence. Through mock interviews and real-world case studies, students gain hands-on experience. SRM School of Banking’s BFSI training course ensures that graduates are industry-ready and well-prepared to step into BFSI roles immediately after completion.

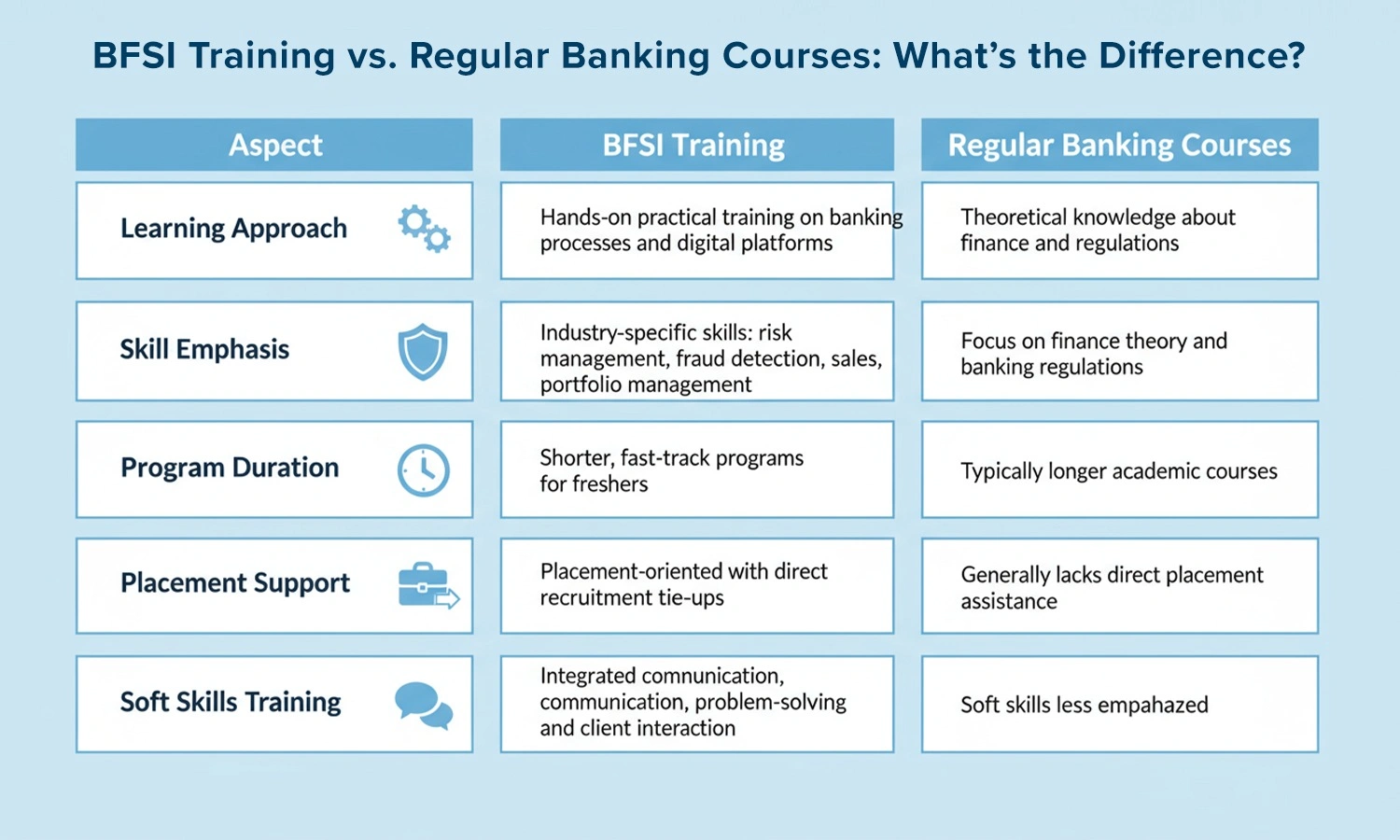

BFSI Training vs. Regular Banking Courses: What’s the Difference?

Unlike regular banking courses that focus mainly on theory and finance fundamentals, BFSI training emphasizes hands-on learning across banking operations and digital platforms. These shorter, placement-oriented programs build real-world skills in risk management, sales, and portfolio handling with direct recruitment tie-ups. They also include soft skills training in communication and client handling, which traditional academic courses often lack.

This comparison highlights why BFSI training for freshers is the smarter choice for those seeking fast-track entry into high-potential BFSI roles.

Placement Opportunities After BFSI Training

One of the biggest advantages of BFSI training is placement support.

- Direct Bank Recruitment: SRMSB partners with HDFC, ICICI, Axis, Kotak, and other top banks.

- Entry-Level Roles: Positions such as Customer Service Officer, Relationship Manager, Loan Officer, and Insurance Executive.

- Career Growth: Promotion opportunities into managerial roles within 3–5 years.

- Assured Placement Programs: Graduates receive guaranteed interview opportunities through the BFSI course with placement.

How BFSI Training Prepares You for Banking Job Interviews

BFSI training focuses on holistic interview readiness. Students receive guidance on aptitude and reasoning tests, communication workshops, and mock interviews tailored to real bank hiring processes.

The BFSI placement training modules simulate live recruitment rounds, helping students build confidence. Industry insights, digital banking exposure, and compliance understanding ensure that candidates perform exceptionally well during final interviews and assessments.

Soft Skills + Technical Skills Blend in BFSI Programs

Modern BFSI roles require professionals with both technical and interpersonal strengths. The BFSI skills training curriculum integrates:

- Technical skills like digital banking, financial analysis, and risk assessment.

- Soft skills such as negotiation, communication, and time management.

- Sales and customer relationship expertise for client-facing positions.

This well-rounded skill set ensures every graduate is adaptable, employable, and ready for real-world challenges.

SRM School of Banking’s Role in BFSI Training & Assured Jobs

SRM School of Banking plays a transformative role in shaping banking careers for freshers. Its BFSI industry training combines academic excellence with field exposure through case studies, roleplays, and digital banking labs.

With direct tie-ups with private banks and a strong placement assured program, SRMSB ensures that every student receives practical training and verified recruitment support.

Enroll today and step confidently into India’s growing BFSI industry.

FAQs

Fresh graduates from any stream, especially commerce or finance, are eligible.

Typically 3–6 months, depending on program intensity and specialization.

Customer Service Officer, Relationship Manager, Loan Officer, and Insurance Executive.

SRM School of Banking offers BFSI courses with placement and recruitment tie-ups.

Because it offers an industry-aligned curriculum, mock interviews, and assured job opportunities with leading private banks.