Key Takeaways

- Tech-driven banking careers: Emerging technologies like AI, blockchain, RPA, and IoT are transforming banking roles and creating new career paths.

- Hands-on skills matter: Students who gain knowledge in AI tools, blockchain, IoT platforms, and cybersecurity are highly sought after by banks.

- Future-ready graduates: Understanding and applying modern banking technologies gives students a competitive edge for BFSI and digital banking jobs.

How Artificial Intelligence is Shaping the Future of Banking

Artificial Intelligence (AI) is emerging technologies in banking revolutionizing the BFSI sector by automating routine tasks, enhancing decision-making, and personalizing customer experiences. Banks use AI for fraud detection, credit scoring, customer service chatbots, and predictive analytics.

Machine learning algorithms analyze vast amounts of transaction data to identify patterns and recommend financial solutions. Students familiar with AI banking applications, data analytics, and algorithmic models are well-prepared for roles like AI banking analyst, data scientist, and fintech developer.

Blockchain Technology and Its Impact on Banking Careers

Blockchain ensures secure, transparent, and tamper-proof transactions in banking. Key applications include:

- Secure Transactions: Immutable ledger for safer banking operations.

- Smart Contracts: Automate agreements and reduce manual intervention.

- Cryptocurrency Integration: Facilitate digital currency payments and investments.

- Career Opportunities: Blockchain developer, fintech consultant, crypto analyst.

Students who understand blockchain protocols, smart contracts, and cryptocurrency platforms gain an edge in innovative BFSI roles.

Get Trained. Get Placed. Get Ahead in Banking – Enroll Now! in SRM school of banking

Robotic Process Automation (RPA) in Banking Operations

RPA is transforming back-office operations by automating repetitive tasks like data entry, reconciliation, and compliance reporting. This reduces operational costs and errors while enhancing efficiency.

Careers in RPA include process analyst, RPA developer, and automation consultant. Students trained in RPA tools and workflow automation can contribute immediately to modern banking operations and digital transformation projects.

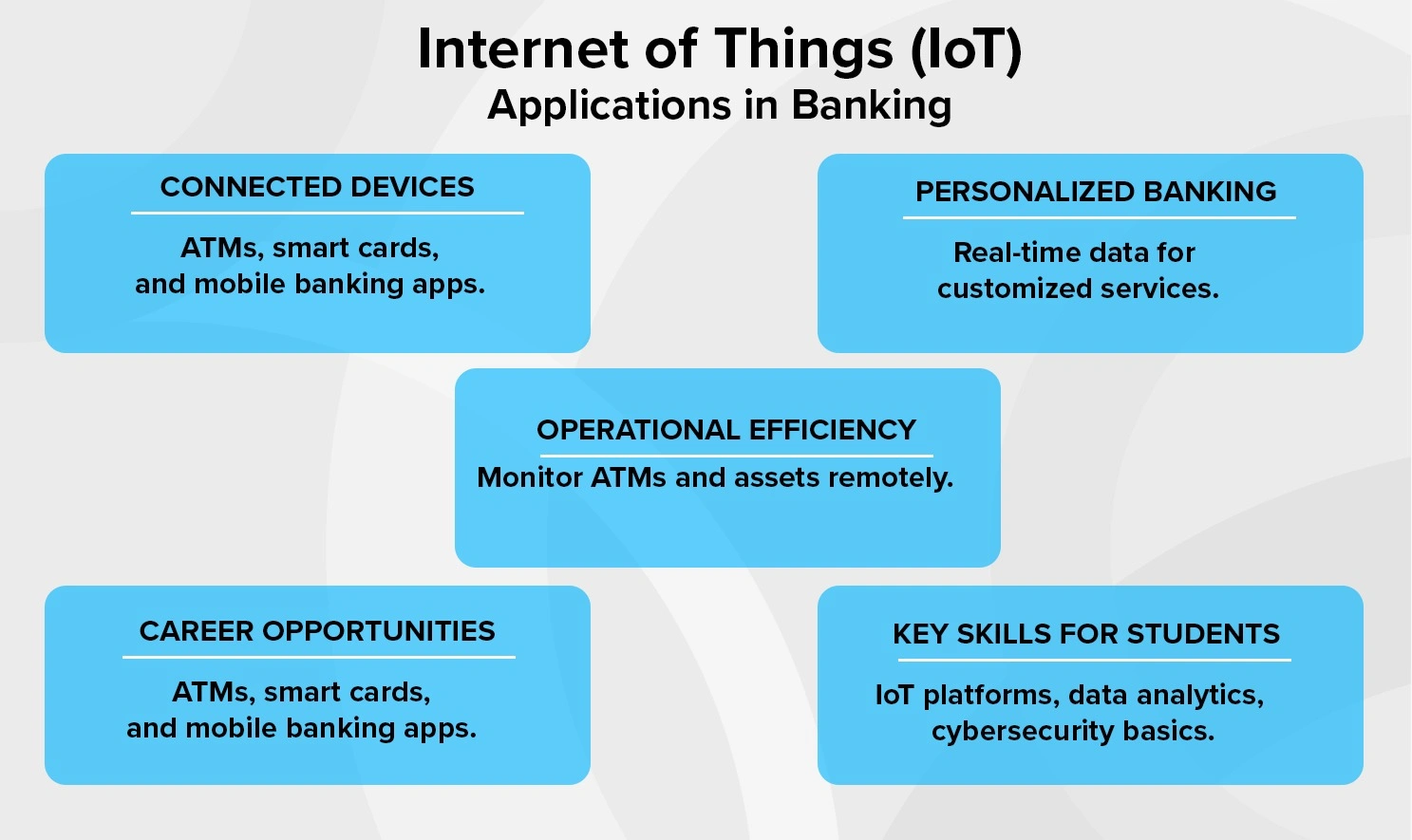

Internet of Things (IoT) Applications in Banking

IoT connects devices, customers, and banks for smarter operations. Key applications include:

- Connected Devices: ATMs, smart cards, and mobile banking apps.

- Personalized Banking: Real-time data enables customized services.

- Operational Efficiency: Monitor ATMs and assets remotely.

- Career Opportunities: IoT analyst, data scientist, fintech developer.

- Key Skills for Students: IoT platforms, data analytics, cybersecurity basics.

To empower banks to deliver personalized services and enhance student employability in tech-driven banking roles.

Cybersecurity and Emerging FinTech Innovations Every Student Should Know

As banking becomes more digital, cybersecurity is critical. Banks need experts to prevent data breaches, secure online transactions, and ensure regulatory compliance. Students should focus on threat detection, encryption techniques, and secure software development.

Emerging FinTech innovations, like digital wallets, AI-based credit scoring, and blockchain solutions, complement cybersecurity knowledge. Graduates proficient in cybersecurity and FinTech innovations are highly valued in modern BFSI careers.

At SRM School of Banking students don’t just learn about these emerging technologies—they master them through hands-on training and expert-led sessions. Enroll now to gain the skills, confidence, and industry exposure needed to build a future-ready banking career.

FAQs

AI, blockchain, RPA, IoT, and cybersecurity are essential for modern banking careers.

AI is applied in fraud detection, predictive analytics, customer service chatbots, and credit scoring.

Technologies like blockchain, IoT-enabled banking, AI-powered analytics, and RPA-driven automation dominate 2025.

Enroll in BFSI courses, gain hands-on experience in AI, blockchain, IoT, and cybersecurity, and stay updated with FinTech innovations.